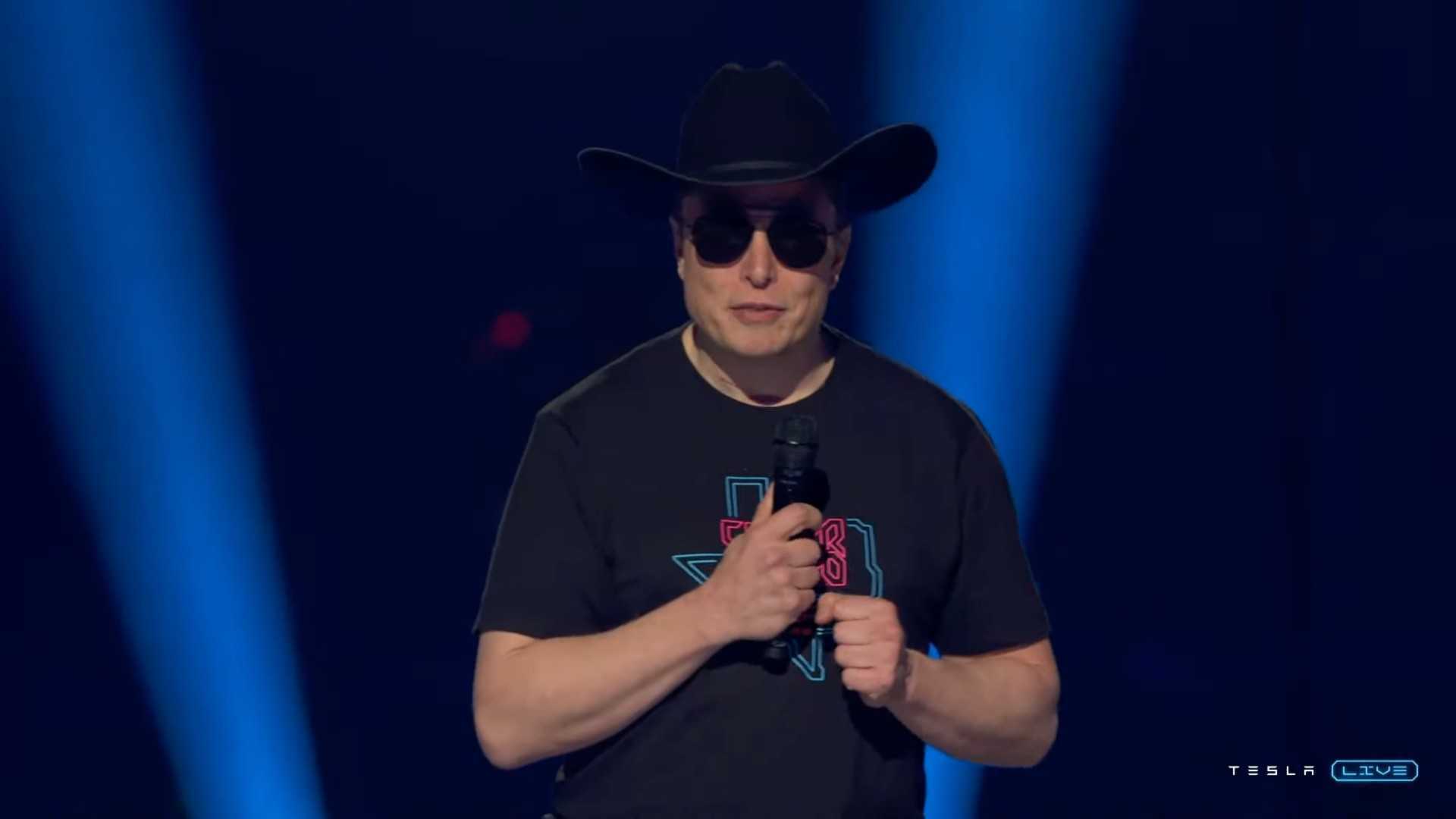

Even for Elon Musk, who summarily rejects the rules other CEOs play by, this one was an extraordinary move to make out in the open.

On Monday, Musk took to X to, essentially, demand more control of Tesla from the carmaker’s board. “I am uncomfortable growing Tesla to be a leader in AI & robotics without having ~25% voting control. Enough to be influential, but not so much that I can’t be overturned,” he said in a post on the social media platform, which he owns.

Get Fully Charged

Elon Musk wants more control of Tesla

Elon Musk has been viewed as incredibly important to Tesla’s meteoric rise. Now he wants more control of the company to stay in the picture.

Musk, Tesla’s longtime CEO who oversaw its growth from a shaky startup to a global powerhouse worth several times more than any legacy competitor, insinuated he’d step back or find something else to do without more voting power: “Unless that is the case, I would prefer to build products outside of Tesla.”

Musk is no stranger to creating controversy on X/Twitter, even long before he owned it; this statement has echoes of the infamous “funding secured” debacle from a few years ago. So why would he post such a thing now?

Over the years, an unusual compensation package that rewarded Musk with large chunks of Tesla stock for hitting certain performance benchmarks made him the richest person on the planet. Tesla’s meteoric rise eas earned Musk a net worth of more than $200 billion, according to the Bloomberg Billionaires Index, and left him with some 13% of the carmaker’s shares (after offloading some to fund his Twitter acquisition.)

He has been viewed as indispensable to Tesla’s success, granting him leeway that no other executives of major companies enjoy. (Hence him publicly saying he’ll walk if he doesn’t get more of Tesla.)

But, more importantly, Musk’s plan to take Tesla to the next level—to transform it from a car company into a multi-trillion-dollar AI and robotics company—has yet to bear fruit. A primary reason for Tesla’s nearly $700 billion value (down from a 2022 high of $1 trillion) is Musk’s assertion that Tesla is a groundbreaking AI company, not a mere car company. That’s despite nearly all of the company’s revenue coming from vehicle sales. Automakers like General Motors and Toyota sell millions more vehicles than Tesla does each year—but Wall Street values them at hundreds of billions of dollars less.

For several years, Musk has claimed that self-driving Tesla taxis were just around the corner. But Tesla’s poorly named Full Self-Driving feature is still in a prototype phase and very much cannot drive itself. Some experts doubt that Tesla’s current strategy will ever produce truly autonomous vehicles.

.

Musk has also said that Tesla’s new robot project, which is developing artificially intelligent humanoids that can do manual labor, would eventually eclipse its car business. But that’s a long, long way away. (The Optimus bot did just fold a shirt, though, so that’s cool.)

Meanwhile, Tesla’s EV business is facing stiffer competition than ever—particularly from China’s BYD, which just overtook Musk’s firm as the global EV sales leader. Tesla has had to slash vehicle prices, eating into its profit margins. The company still hasn’t delivered on a longstanding promise to launch a cheap model, widely seen as necessary for it to significantly grow its sales volumes down the line. Since the start of the year, Tesla has shed $94 billion off of its market cap.

Yet Musk making good on his threat to actually leave Tesla—which, again, is the primary source of his wealth—seems as unfathomable as it is to imagine Tesla without him. And what that even looks like is a closely guarded secret within the automaker.

Between justifying its enormous valuation with AI innovation and continuing to grow its car business as automotive giants pile into the EV market, Tesla has its work cut out for it. Whether Musk will be along for the ride is now an open question.

Contact the author: [email protected]