Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

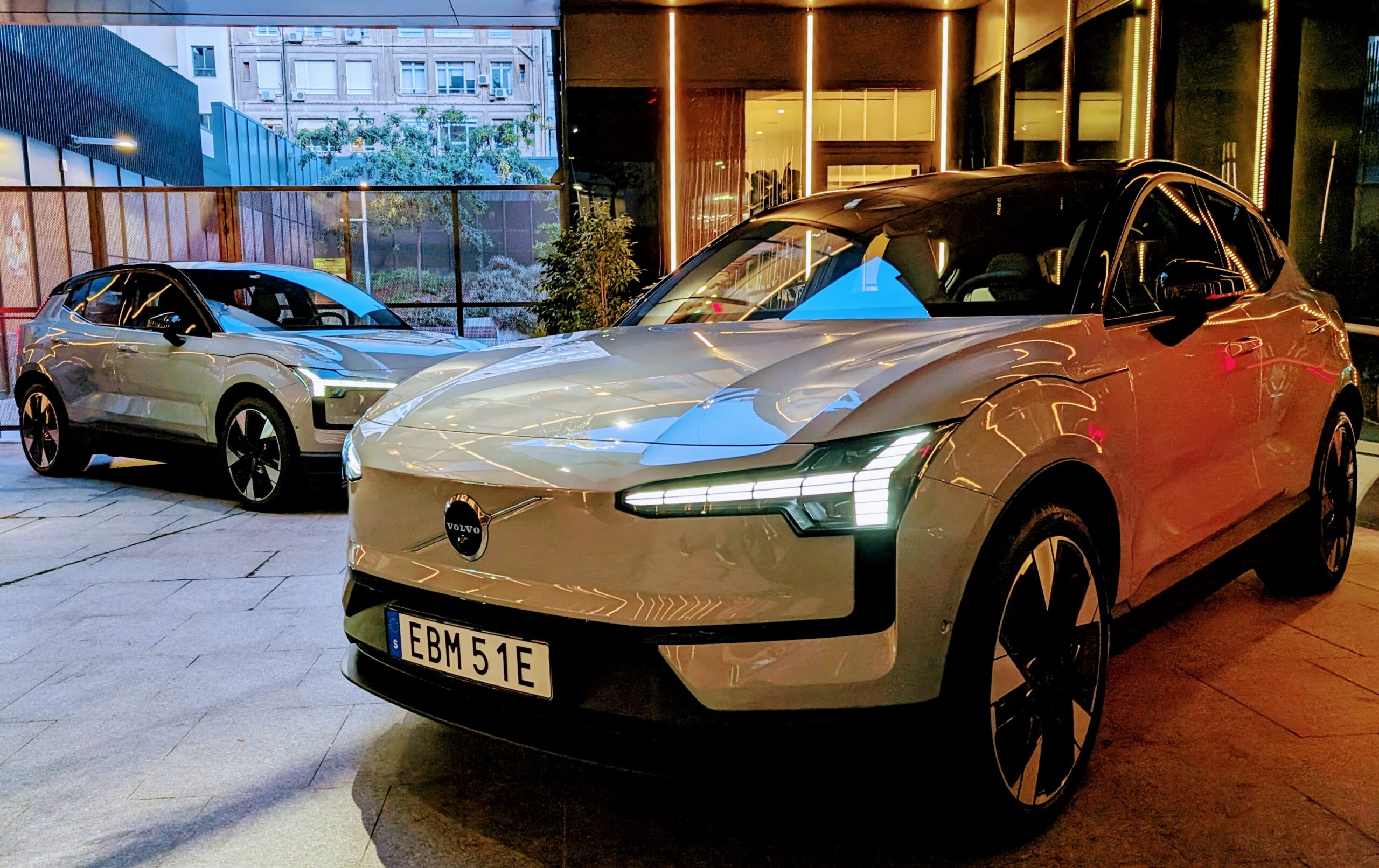

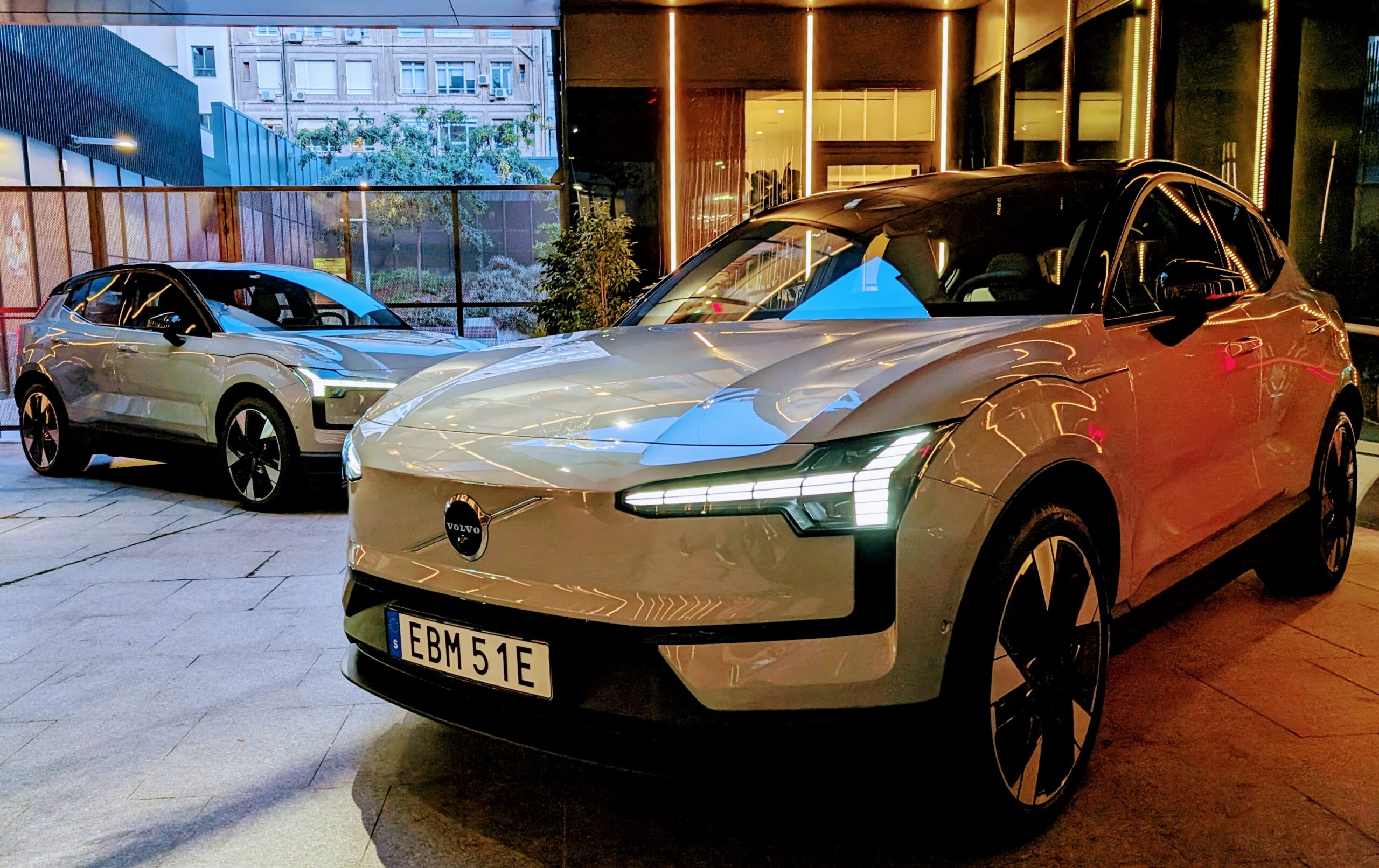

Volvo EX30 #1 in April

In a negative month in the overall market (down 4% to 28,432 units), April saw plugin registrations increase by 11% YoY, to 13,274 units. As a result, the Dutch plugin vehicle (PEV) market reaching 47% last month, in line with the year-to-date average. That’s mostly thanks to pure electrics (32% of new vehicle sales). With 9,092 registrations, pure electrics (BEVs) represented 69% of all plugin sales last month, above the YTD average of 66%.

Comparing the current results with 2023, we are already above the full year score (44% PEV, 31% BEV), and more importantly, a full 7% above the results presented 12 months ago. This points to the possibility that the Dutch EV market could cross the 50% mark already this year and finish the year at around 51% share, with BEVs at 36%! Now, that would be some good news! (Especially considering the current doom and gloom of some reports … but I digress.)

At this pace, the Dutch market could reach some 80% plugin share by 2028, and around 90% by 2030, which is not bad at all….

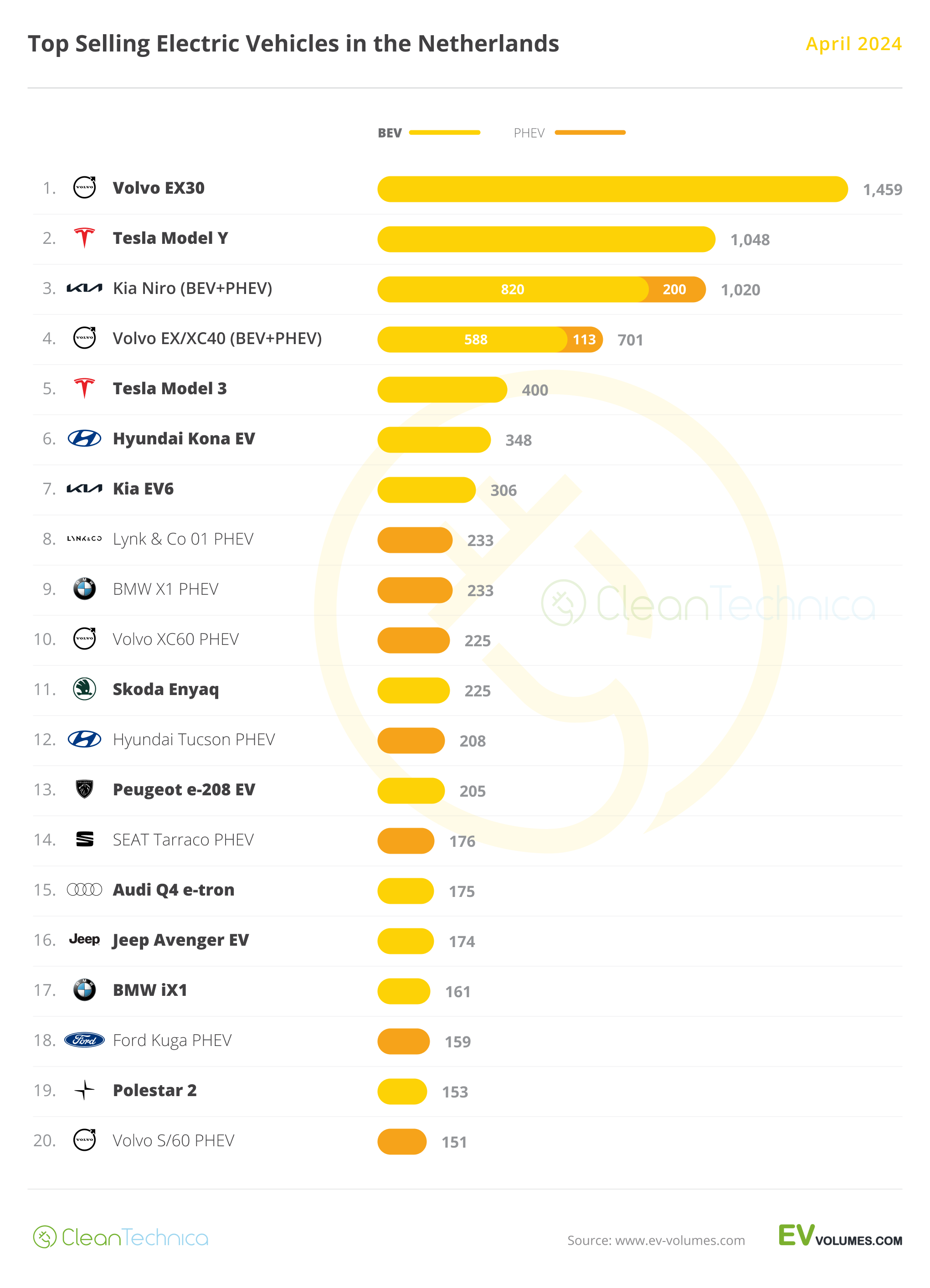

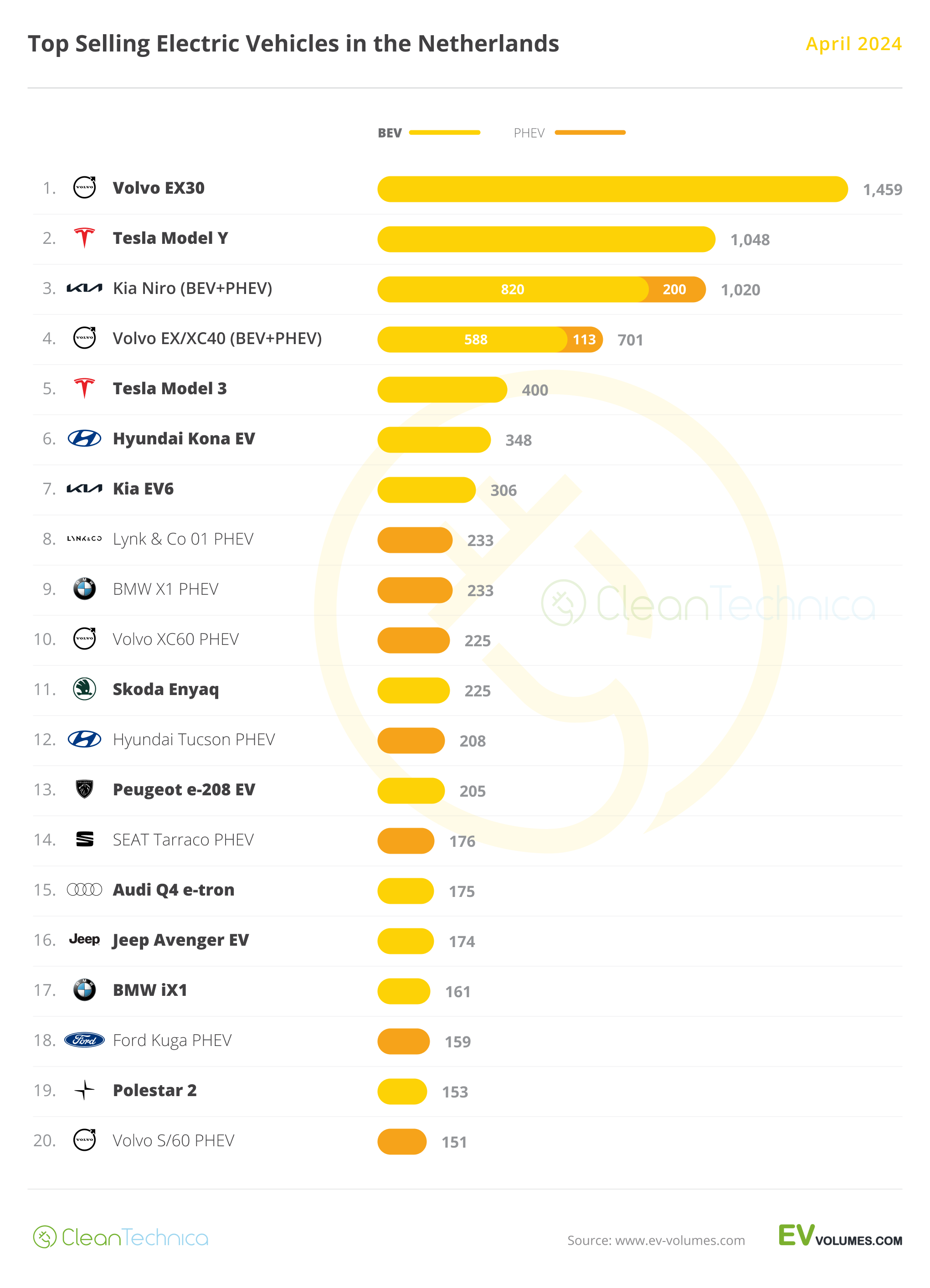

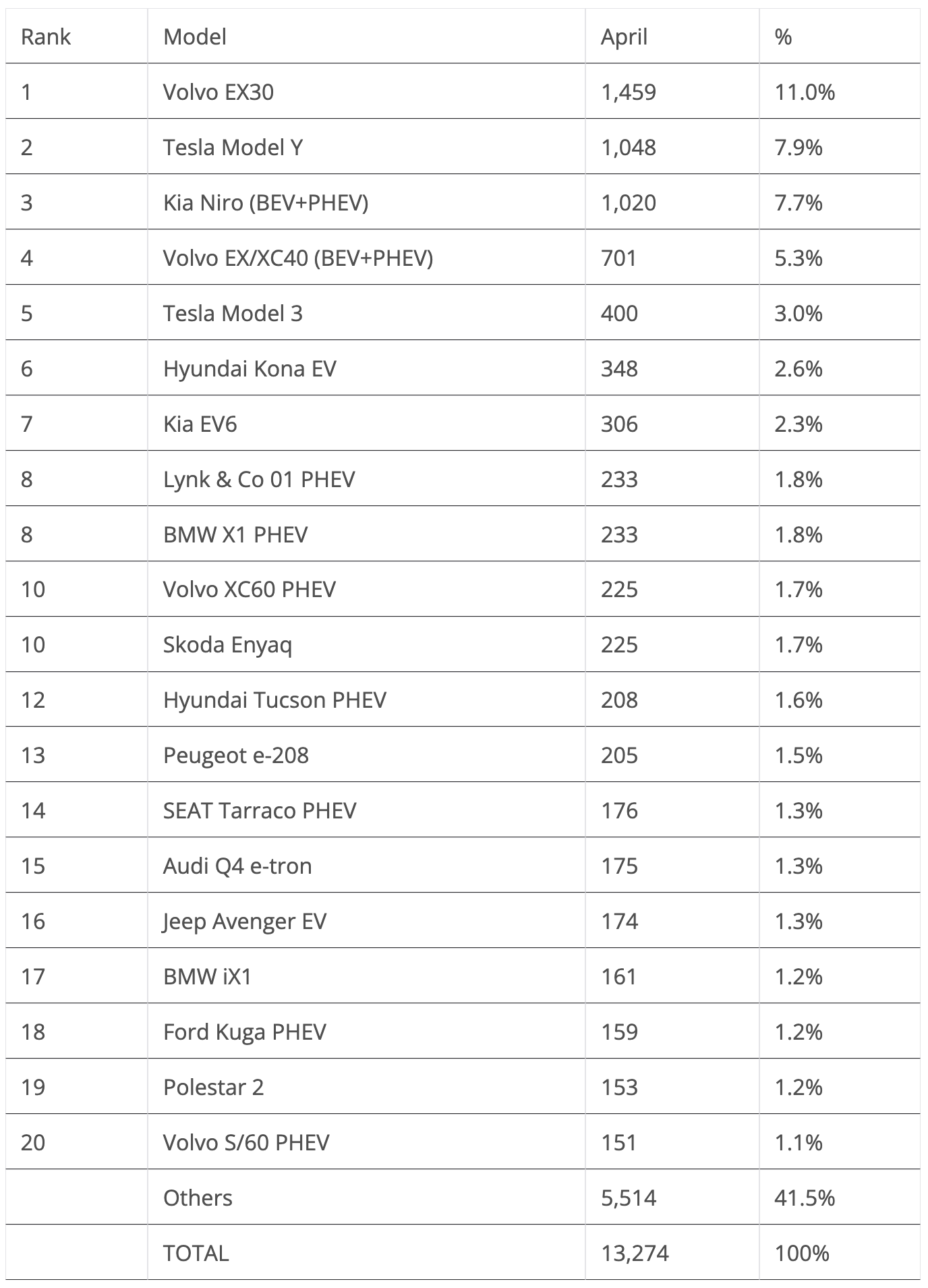

In April, the Volvo EX30 was first in the plugin table, with 1,459 registrations. It was second overall, while its Belgian-made Volvo EX/XC40 siblings were 4th, with 701 registrations. So, it was another good month for the Swedish make.

The EX30’s career beginnings are starting to remind me of the best Chinese EVs. Its registrations have been consecutively growing ever since it landed in December, proving that the production ramp-up is still on its way. How high will it reach? With the little crossover already #2 in the overall market, the ceiling is already starting to get near….

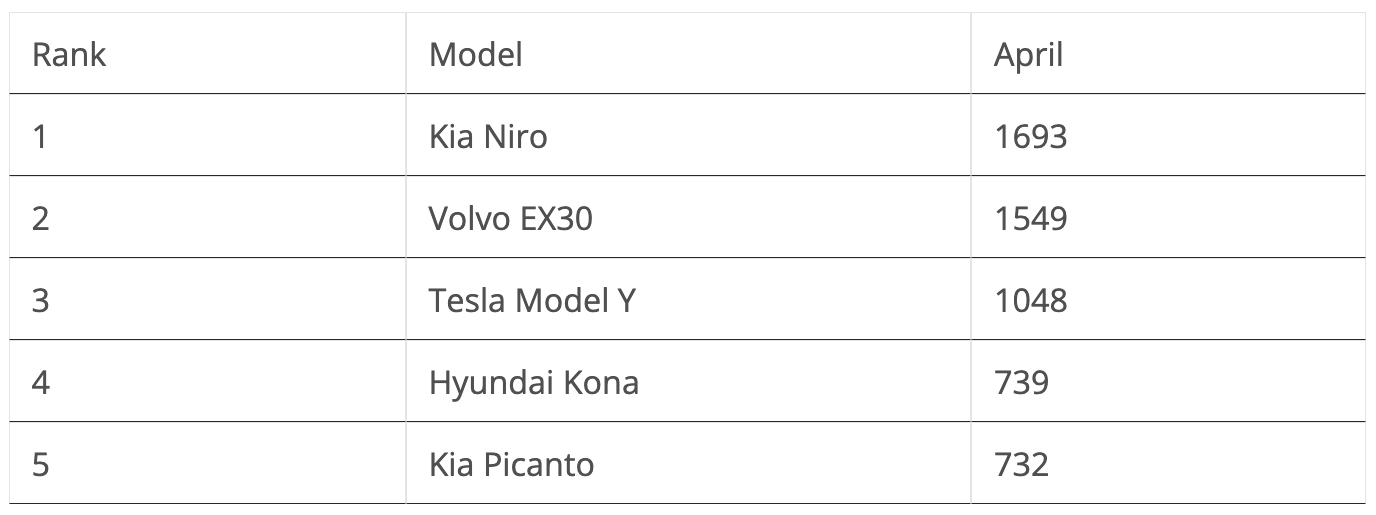

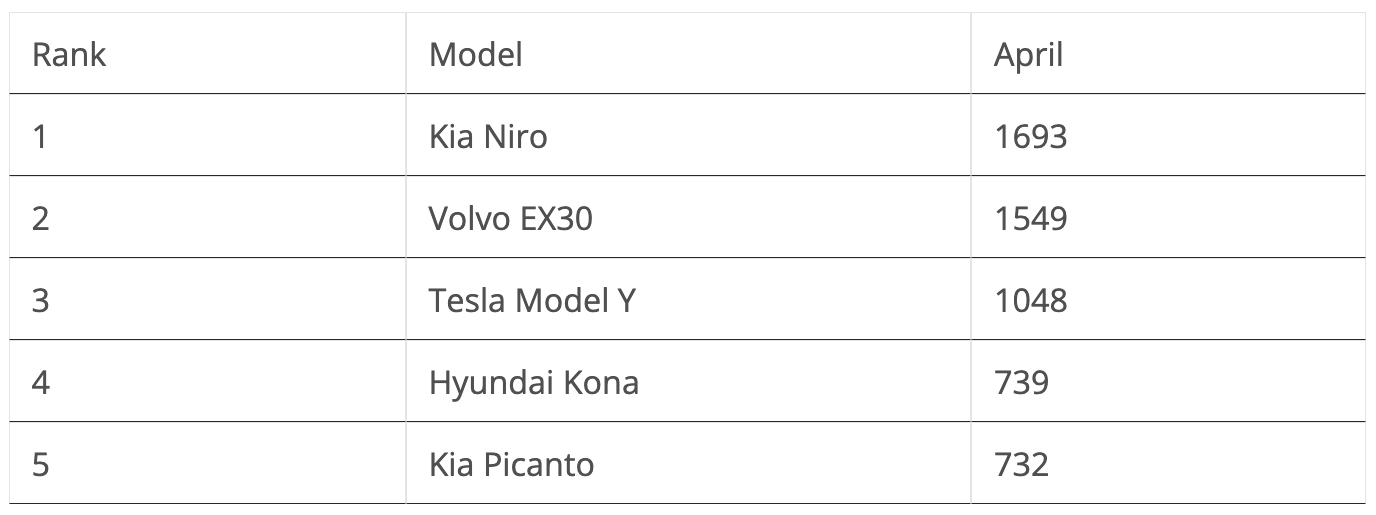

Elsewhere, the Tesla Model Y took silver in April, with 1,048 registrations, while the Kia Niro was 3rd, with 1,020 registrations. The Korean model’s BEV version contributed with 48% of the Kia hatchback on stilts crossover’s 1,693 registrations, while the plugless hybrid had only 40% of the Niro’s sales. The Korean model overall was #1 in the April auto market.

Looking at the overall auto sales table, besides the aforementioned first place of the Kia Niro and the runner-up spot of the Volvo EX30, the Tesla Model Y was 3rd, with 1,048 registrations, thus making it a full 100% plugin podium in the Netherlands. This is another sign that the merge between the plugin and overall markets continues.

The 4th placed Hyundai Kona is also heavily electrified, as 47% of all its sales belong to the BEV version, thanks to 348 registrations. That’s its best score ever since this second generation landed.

Back to plugins, and looking beyond the podium, this time the Ford Kuga PHEV only ended the month in the 18th position, with 159 registrations, allowing the Lynk & Co 01 PHEV and the BMW X1 PHEV (both tied in 8th with 233 registrations) to the best selling PHEV model in this market last month.

Still in the PHEV category, we have a surprise in the table, with the SEAT Tarraco PHEV coming out of nowhere and landing in #14, with 176 registrations. Fleet deal? Other? If someone has any explanation for this surprising performance of SEAT’s 7-seater SUV, please let us know on the comments below….

Elsewhere in the second half of the table, one highlight is the good performance of the Audi Q4 e-tron (#15th, 175 registrations). It and the #10 Skoda Enyaq are the only two representatives of Volkswagen Group’s MEB-platform. Meanwhile, the Polestar 2’s 19th spot, from 153 registrations, and Volvo’s S/V60 PHEV twins, in 20th position (151 registrations) underline Geely–Volvo’s positive month in April.

Heck, even the veteran (it dates back to 2015) Volvo XC90 PHEV had a good month, with the Swedish SUV scoring 115 registrations in April and being the best selling full size plugin in Dutch lands. It’s like what people say: A high tide lifts all boats….

Outside the top 20, and kind of reminding me of China’s recent MPV resurgence, VW’s ID.Buzz Multivan PHEV had a record performance, with 100 units of the large MPV being registered last month. This dwarfs the ID.Buzz result in the same period (16 units), which begs the question: “Why?”

The reason is simple: Volkswagen hasn’t marketed the ID.Buzz properly. Either they made it a large MPV from the start, with acres of space and 7 seats, in order to sell it at premium price, or if they wanted to start the Buzz with a midsized, 5-seat version, they would have needed to sell it at a significantly lower price level, something like €50,000. Because when you have the full-size, 7-seat VW Multivan PHEV selling at €60,000 vs. the midsize, 5-seat ID.Buzz selling at €57,000, then, unless you REALLY want to go BEV-only, the choice is obvious: the Multivan makes more sense.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Still in the Volkswagen stable, the ID.3 registered 141 units, which could mean that the German hatchback could be close to returning to the best sellers table … after a slow start of the year.

Elsewhere, April witnessed good months from the MG4, with 127 sales, while the BYD Atto 3 (Euro-spec Yuan Plus) was close, with 119 sales.

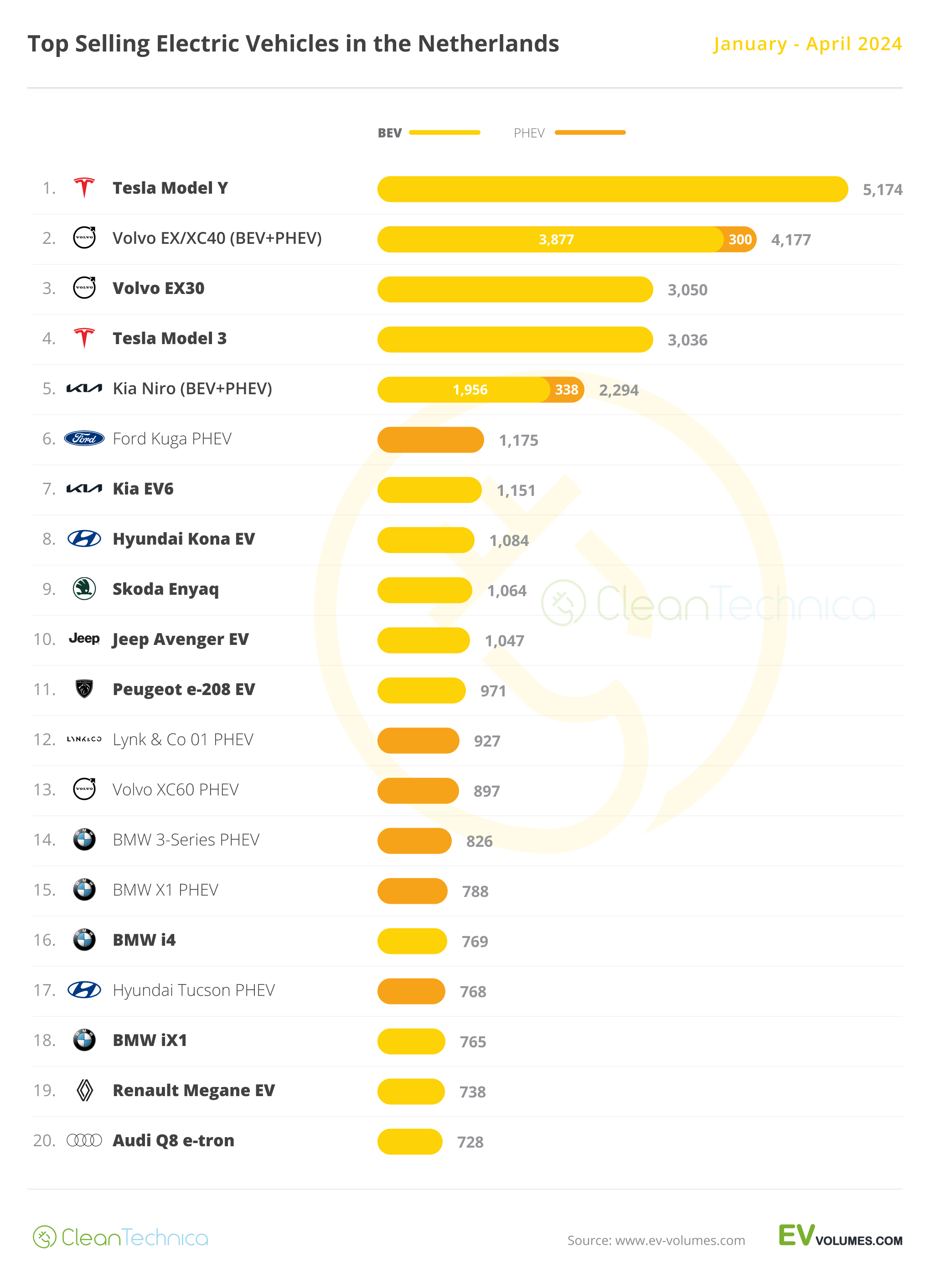

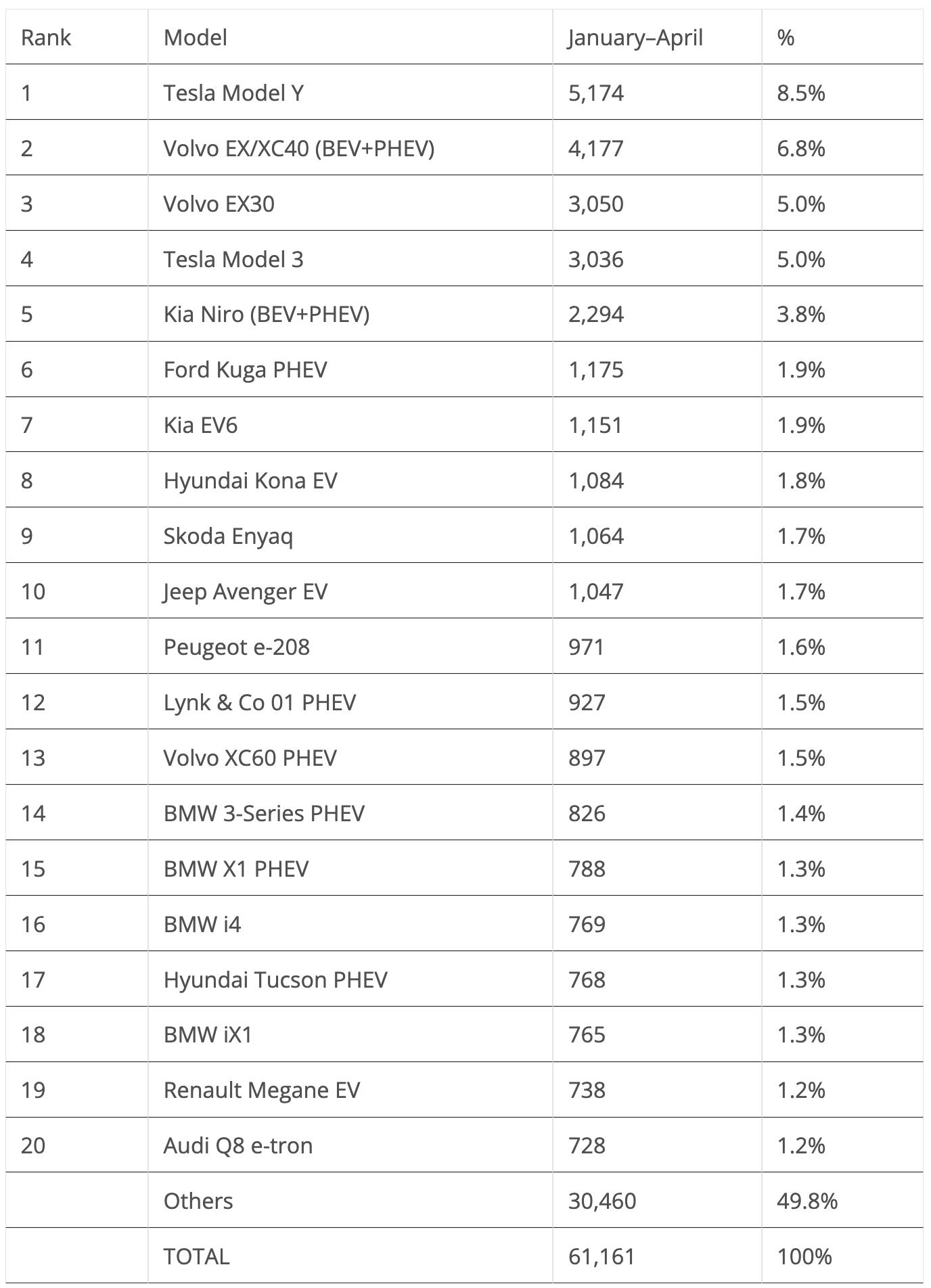

Looking at the 2024 ranking, the Tesla Model Y has some 1,000-unit of advance over the runner-up Volvo EX/XC40, which, in normal circumstances, would allow it to remain comfortable in the lead, but because we are not in those kinds of circumstances, a lot can happen.

I am not talking about Tesla’s current mental meltdown, although that can also affect the Model Y’s future performance, but am referring to the Volvo EX30’s rise and rise. The good looking crossover (kind of reminds of a Polestar) is now in 3rd, after dumping the Tesla Model 3 off of the podium in April. True, with more than 2,000 units separating the two models, it is a tall order, but with the EX30 probably reaching the 2nd spot in June, it will have 6 months to go after the US model.

The top four models are already significantly above the remaining competition, with only the Kia Niro with a real chance to join the podium-fighting group.

As for the rest, the Hyundai Kona EV was the Climber of the Month, jumping three positions into #8, while the BMW X1 PHEV surpassed its stablemate BMW i4, ending the month in 15th.

Finally, note that there are 14 BEVs in the table, which is the same number as 12 months ago and three more than 24 months ago.

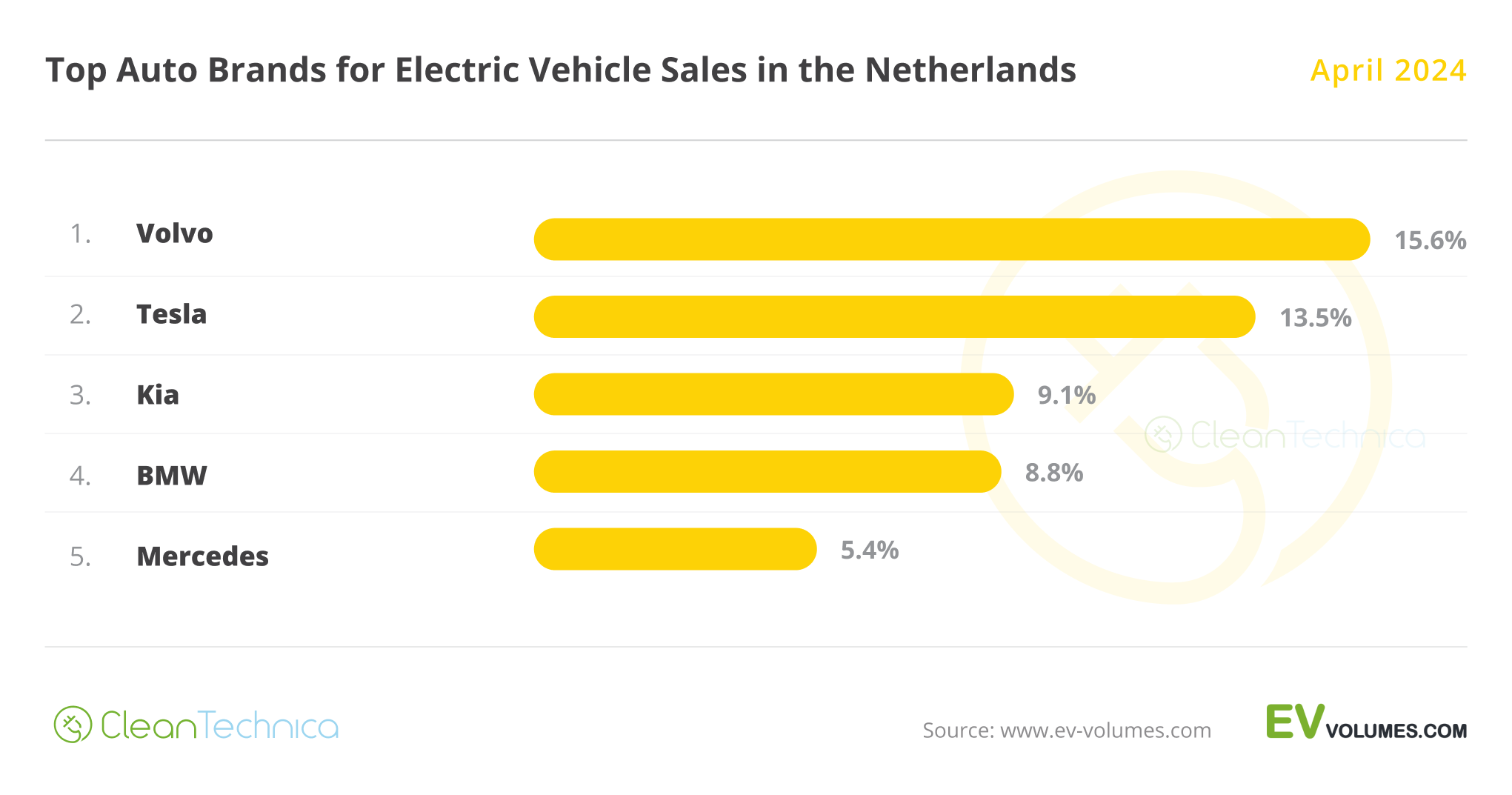

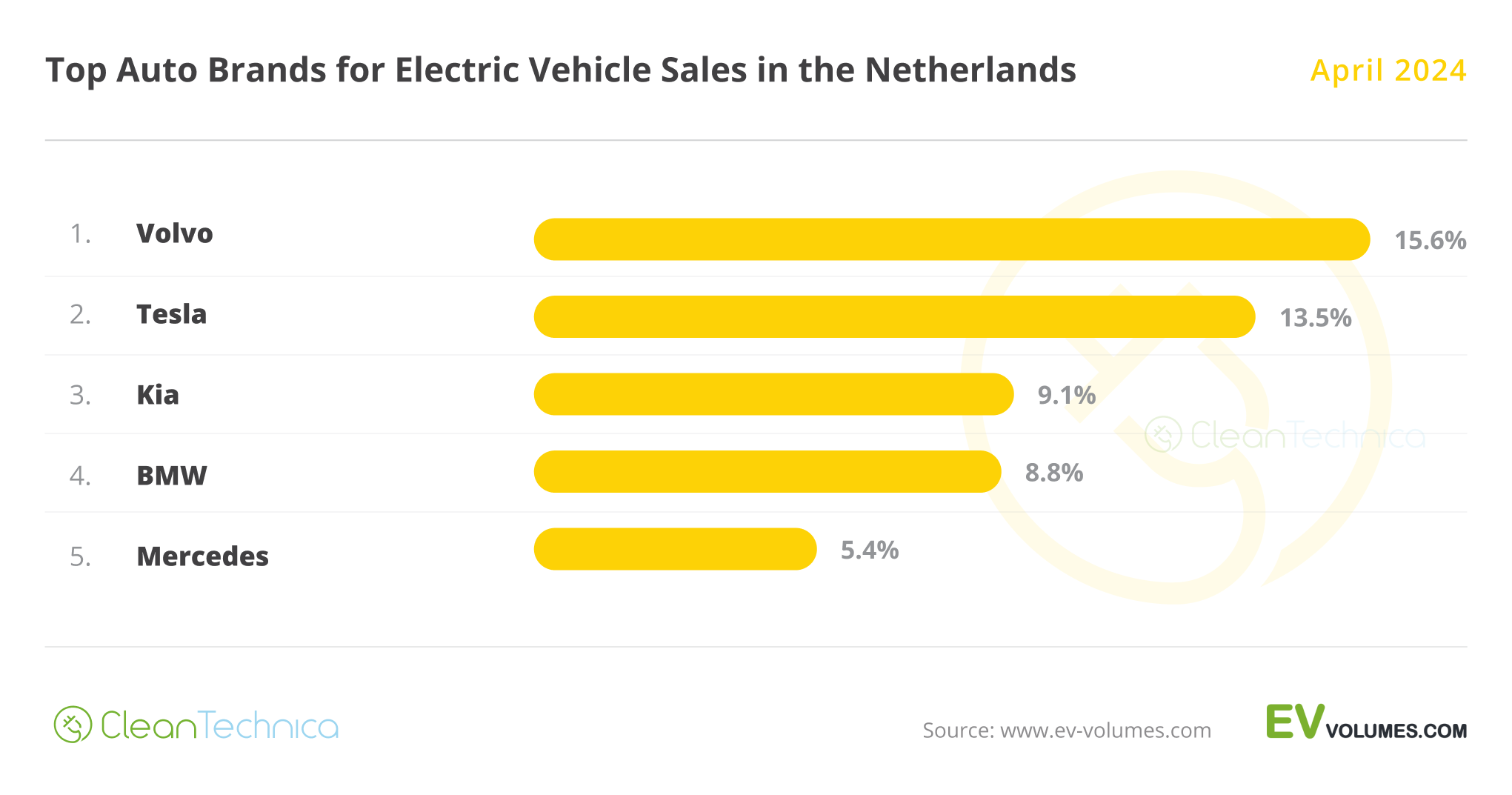

In the manufacturer ranking, leader Volvo continued to rise, now at 15.6%, a full 5% above of what it had in the same period of 2023 (10.6%), while runner-up Tesla is at 13.5%, also a significant 3% share above of what it had 12 months ago.

Meanwhile, a surging Kia (9.1%) surpassed BMW (8.8%) in the race for the 3rd spot, with the Korean make claiming 2.9% more market share, compared to the same period last year.

Finally, in 5th, we have a falling Mercedes (5.4% share), which hasn’t managed to place any model in April’s top 20 and saw the Mercedes GLC slipping out of the YTD best sellers table,. It’s likely that rising Hyundai, now 6th with 4.9% share, will surpass Mercedes soon.

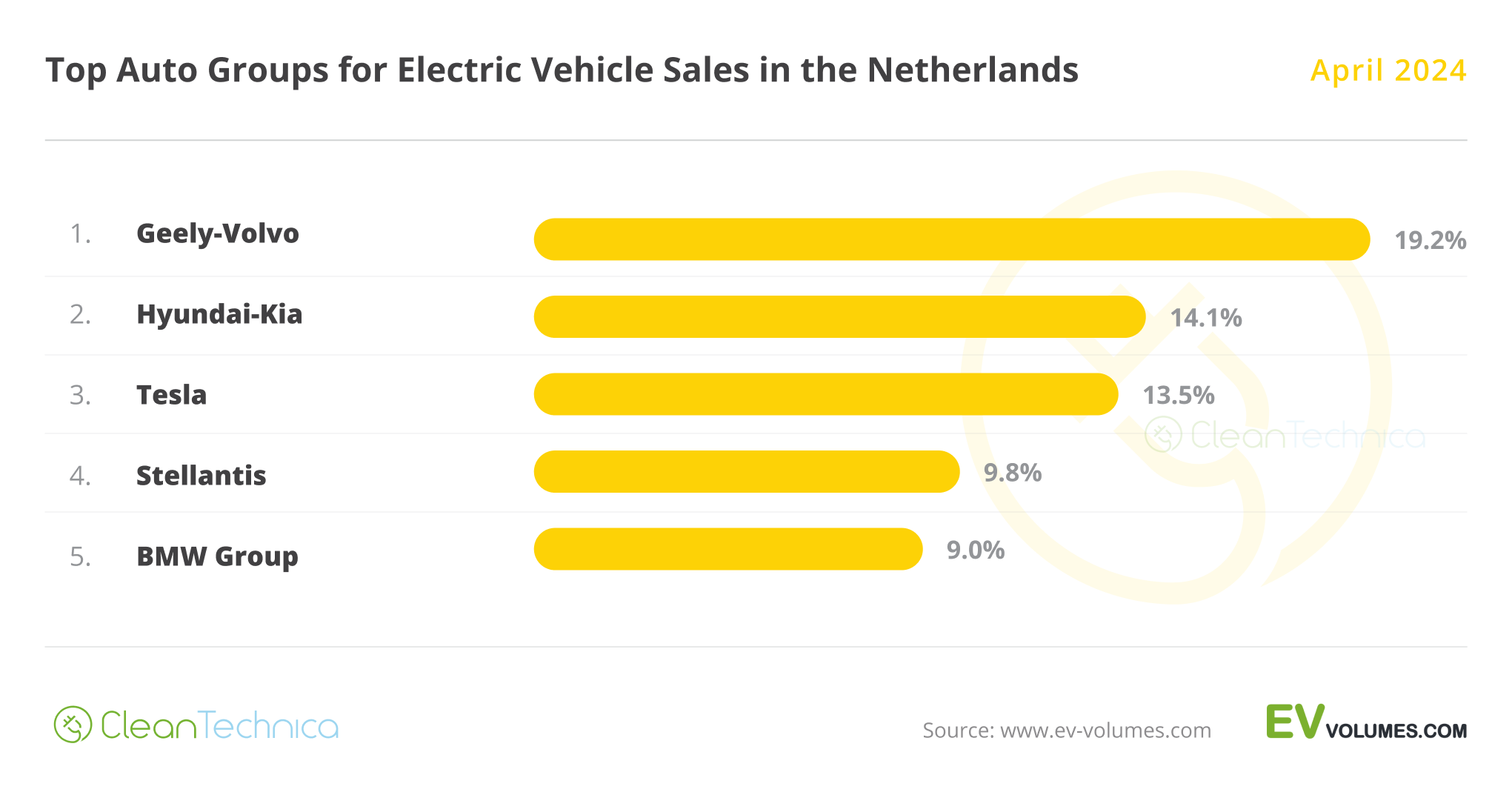

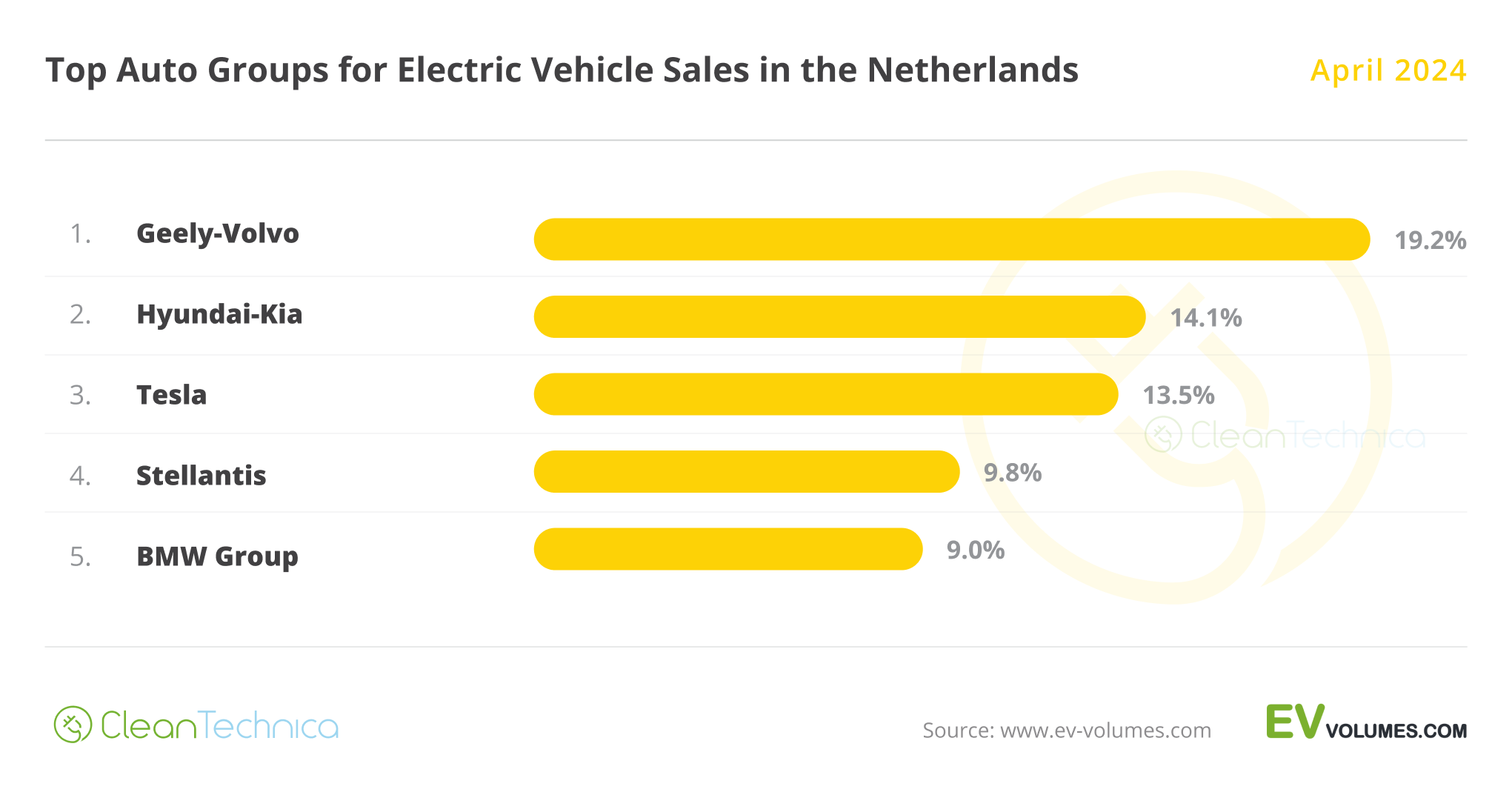

As for OEMs, the leader, Geely–Volvo, is at 19.2% share, which is more or less the same as what it had a year ago (19.1%). That’s because Volvo’s recent rise was dragged down by Lynk & Co’s current sales blues. (The Lynk & Co 01, currently #12, was on the podium a year ago!)

Hyundai–Kia is rising (14.1%) thanks to positive performances from both Kia and Hyundai, thus securing runner-up status instead of Tesla. The Korean OEM had a full 3% advantage over Tesla’s result in April 2023.

Stellantis is 4th, with 9.8% share, while BMW Group is 5th, with 9% share. Both are significantly far from the podium positions.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.