Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

The first trimester is over, and countries are starting to present their official data for vehicle sales during the first three months of the year. Colombia, one of our leaders for EV sales in the region last year, started this one with reasonable growth amidst a generalized crisis in the vehicle sector that has been going on for two years now, with no end in sight. It’s all but certain that by now we have hit peak ICE in this country.

Price reductions have become commonplace in the EV landscape, with some models falling as much as 20% in the last couple of months: these include the Chevy Bolt and Kia Niro (minus 20%, currently at $42,000), the pickup truck Dongfeng Rich-6 (minus 18%, currently at $48,750), and the JAC E10X (minus 15%, currently at $22,300), amongst others. The bad news here is that ICEV models have also been falling in price, as a stagnant market makes it imperative for dealers to clean their inventories.

Regardless, there’s a general feeling that ICEV prices will come back up once the situation improves while BEV prices will remain in a downward trend as more models arrive in the country. Just this month BYD will present the BYD Seagull. Later on, Chery is expected to arrive in the country with its PHEV lineup and, hopefully, the Chery eQ7. Tesla is also expected to arrive soon, and its Model 3 could deal a severe blow to the BYD Seal, provided it maintains the relatively low prices we saw in Chile.

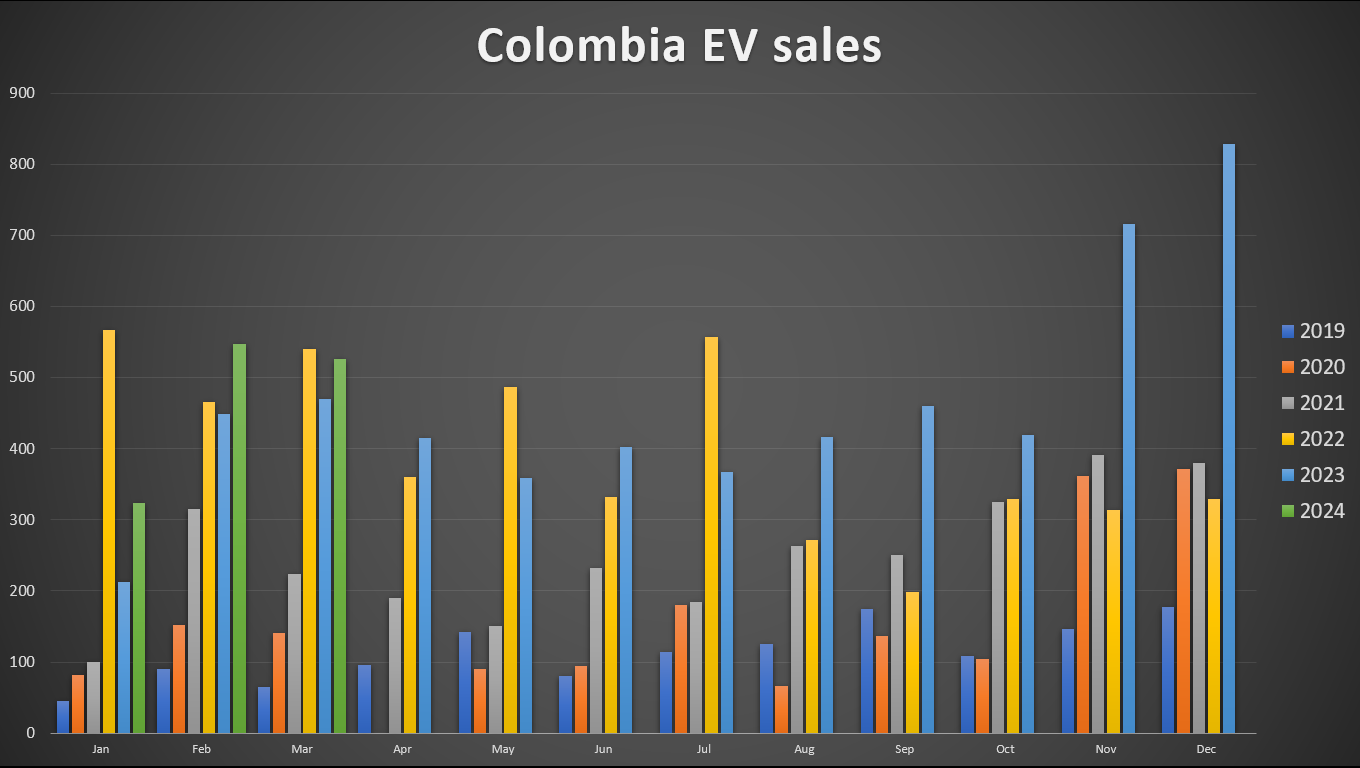

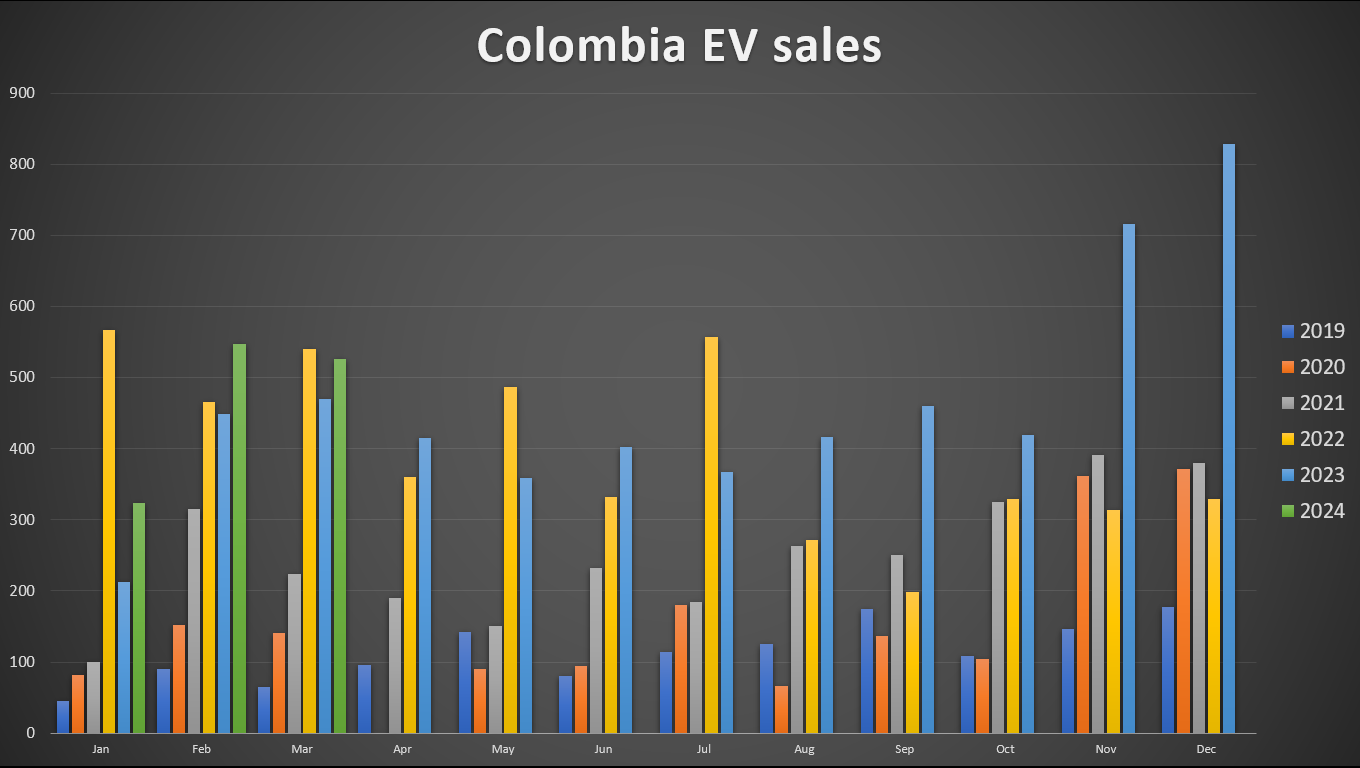

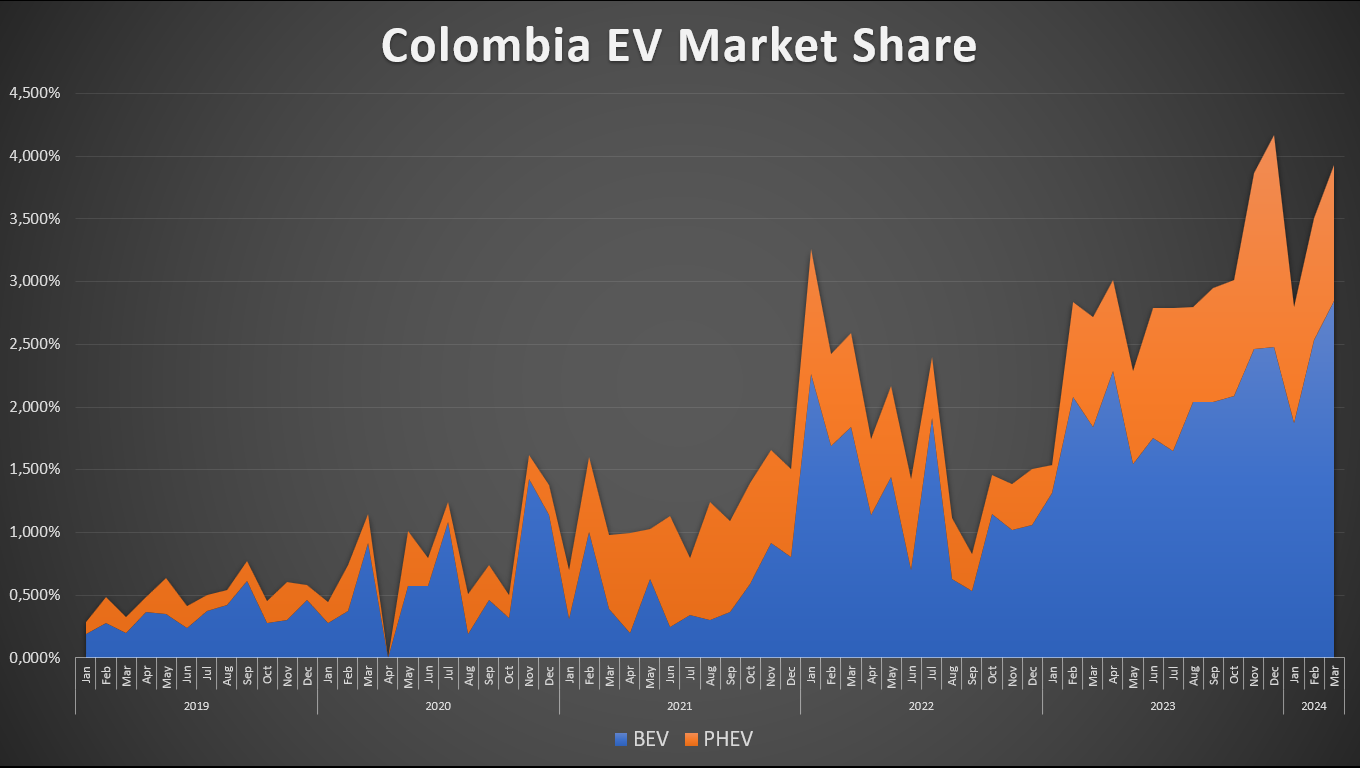

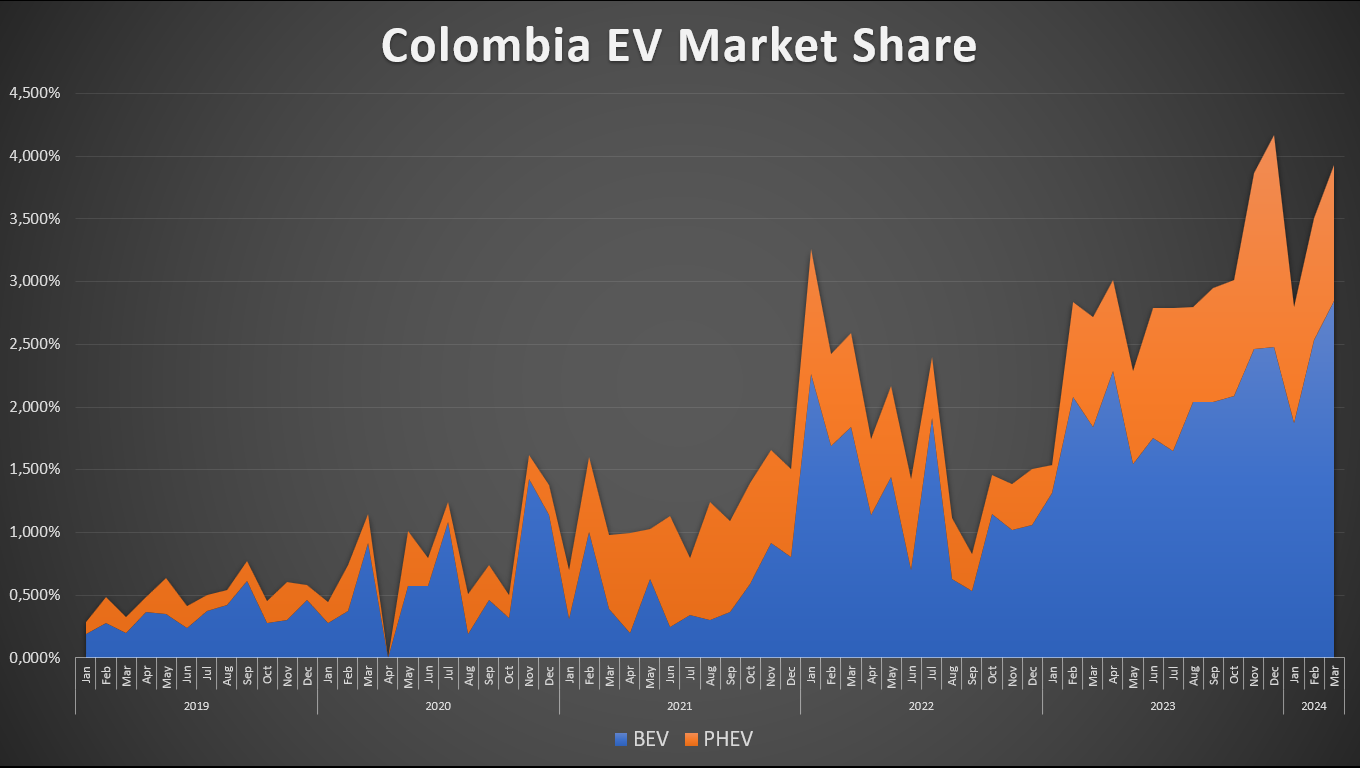

And yet, despite both ICEVs and EVs having significant price reductions, it’s only EVs that grew: 23% to be precise, while the general market fell 14%. This allowed EVs to go from 2.4% market share in Q1 2023 to 3.4% in Q1 2024, reaching 4% during March. While such growth may seem lackluster, keep in mind it’s happening before the arrival of heavy hitters like the Volvo EX30, the Tesla Model 3, and of course the BYD Seagull (Dolphin Mini), the latter of which is already wreaking havoc in the markets of Mexico, Brazil, and Uruguay.

EV sales overview

Colombia’s market is truly minuscule for a country its size: only 40,567 light and heavy vehicles were sold in Q1 2024, of which 994 were BEVs (2.4%) and 403 were PHEVs (1%). Sales have been growing throughout the year as prices keep going down, and I would expect that the arrival of popular and affordable models in the coming months will accelerate this trend. If things go well, we could be seeing 7% EV market share by the latter months of this year, perhaps even higher!

(It’s important to note that the very high sales in January–July 2022 were due to a significant number of electric buses that arrived in Bogota’s Public Transportation System that year. They also happened in an overall market nearly 50% larger.)

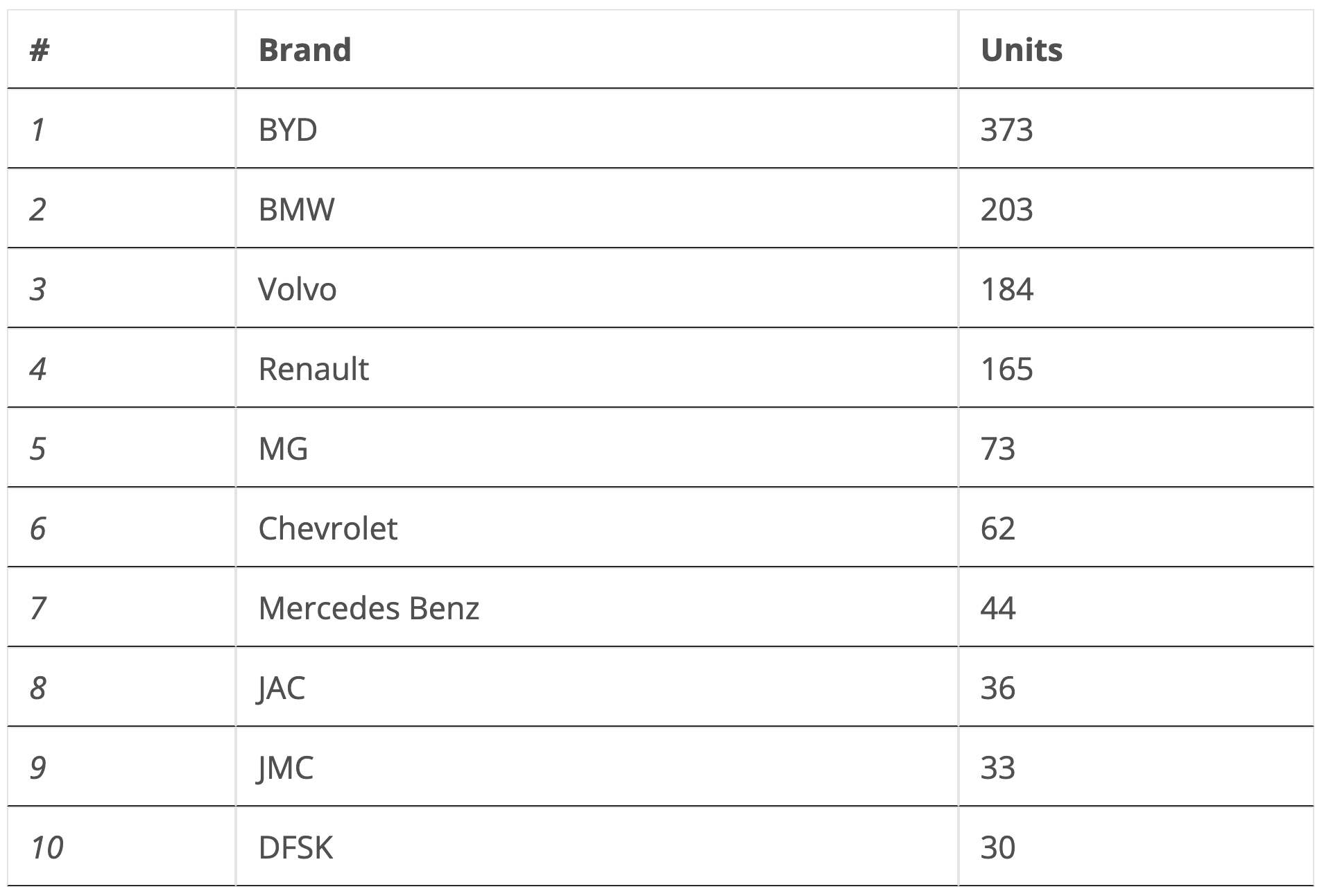

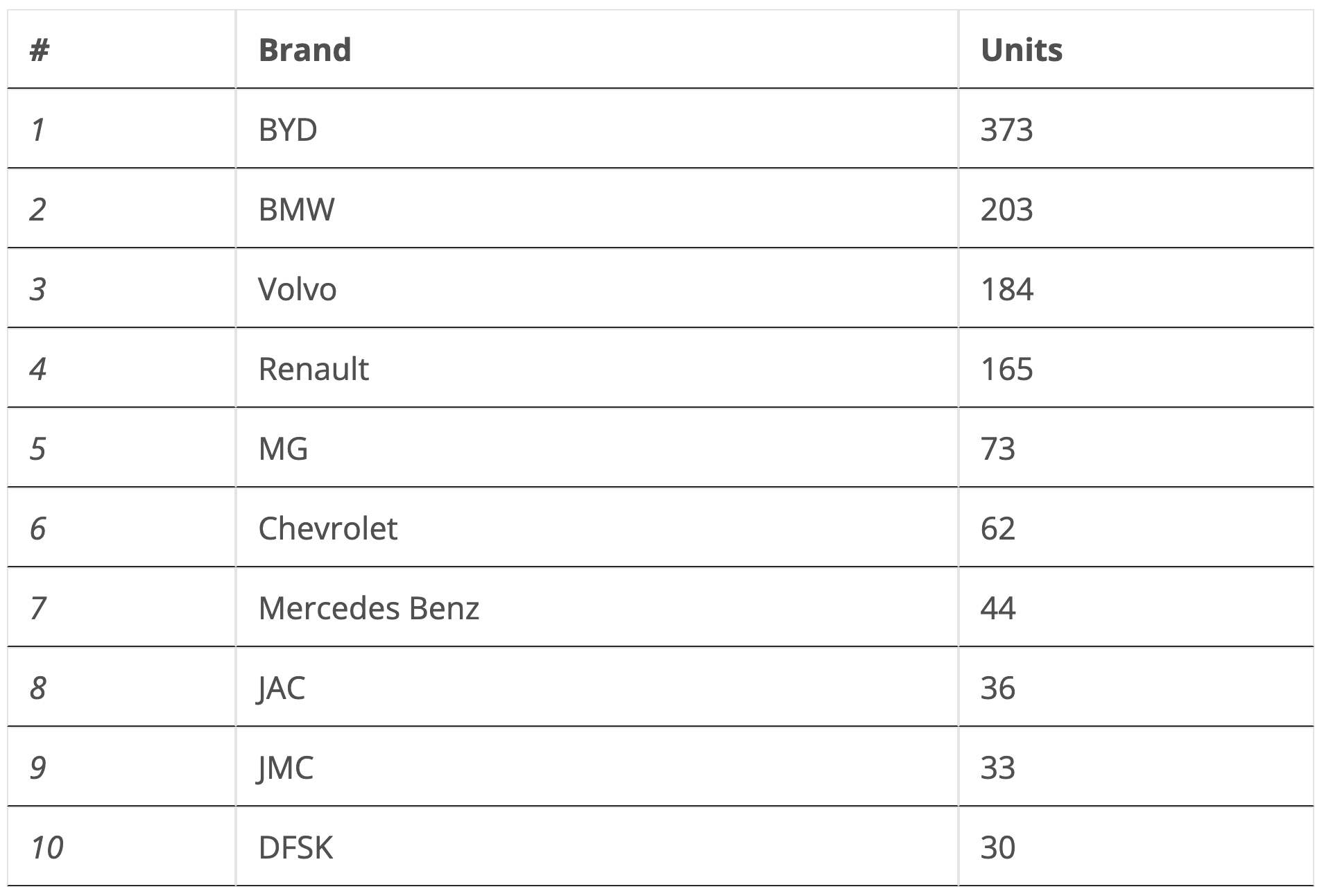

The market is changing rapidly, and while 2023 presented near absolute domination by Chinese brands, 2024 is starting quite different:

Only 5 out of the top 10 are Chinese brands! And even more interesting: three of those stand at the bottom of the list. While there are no surprises regarding the gold (BYD has dominated this market for a while now), the arrival of BMW and Volvo for silver and bronze is surely a surprise, particularly in a market so largely focused on affordable vehicles. Further down, Chevrolet makes an appearance thanks to the Chevy Bolt suddenly becoming popular (it’s impressive what you can achieve when, y’know, you don’t charge absurd amounts for your cars), and there’s a surprising new player here: JMC, a Chinese brand that presented its lineup in November last year and that I had no high hopes for, but which seems to be proving me wrong.

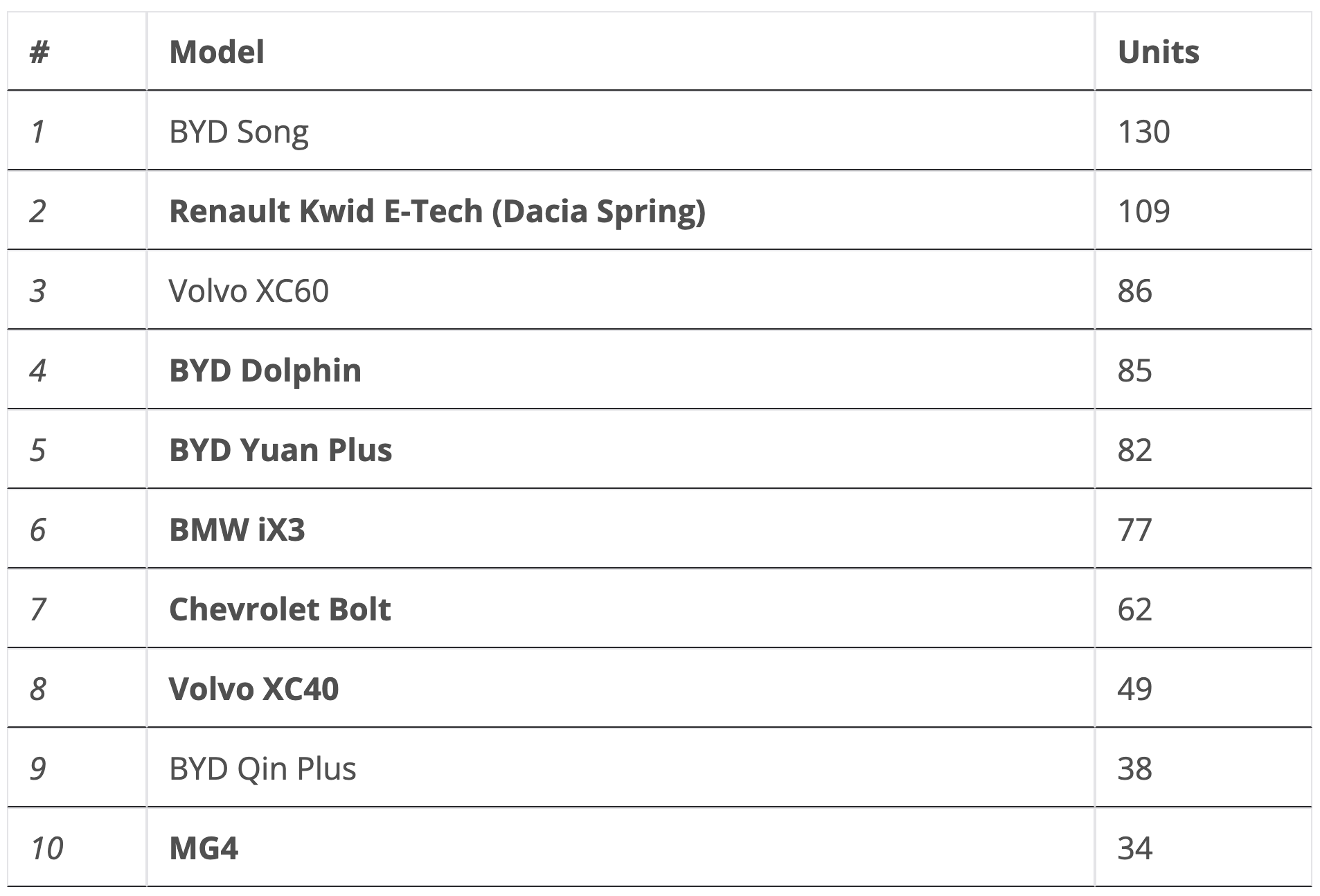

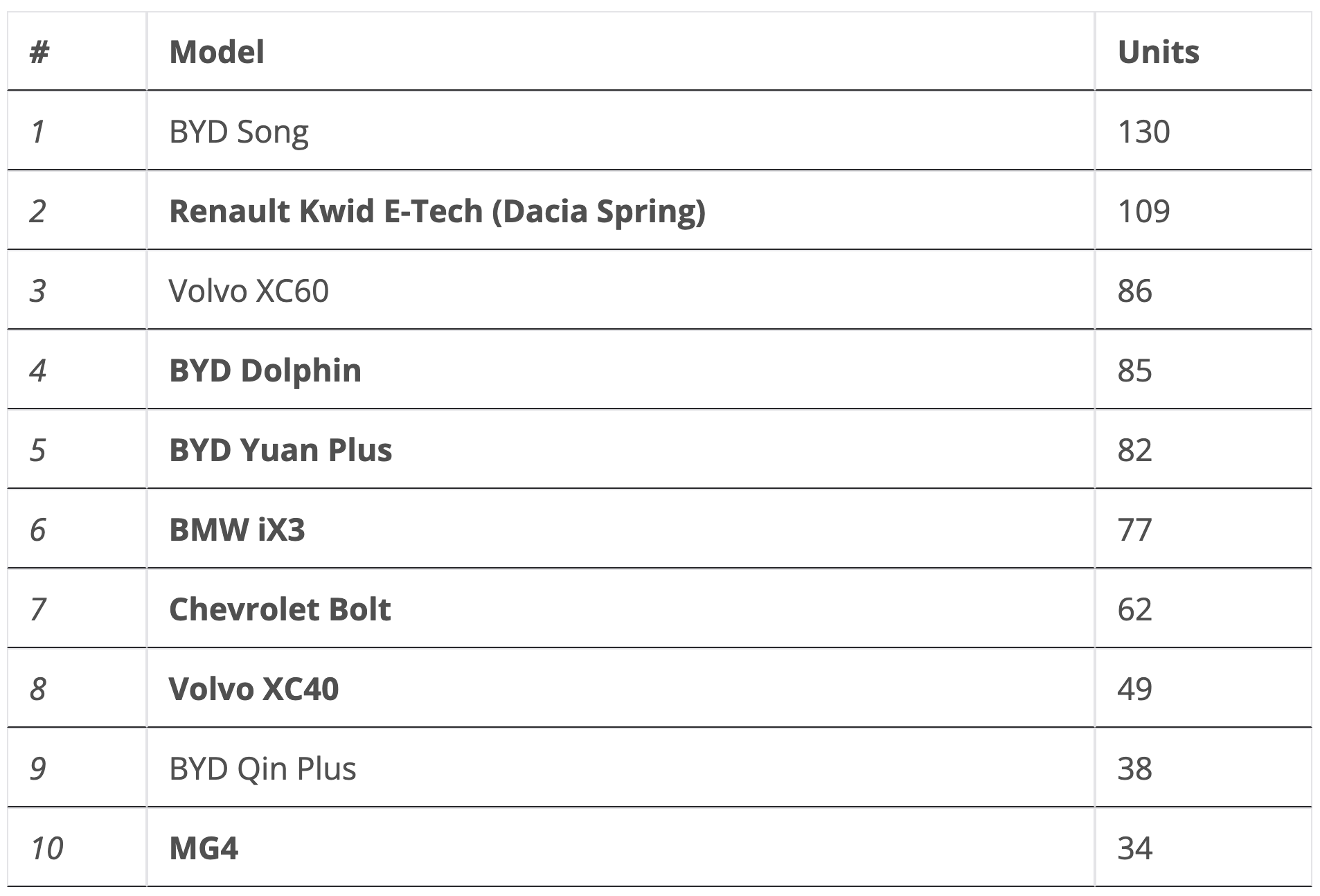

However, when we look at models, things look … different.

At first glance, things seem similar, with 5 Chinese models and 5 from legacy auto. But once we look at the details, we find that two of the legacy auto models are made in China (Renault Kwid, BMW iX3) and another two may be made in China (the Volvos). Only the Chevrolet Bolt remains in this list as a distinct non-Chinese vehicle.

So, this isn’t a matter of “the Chinese are coming.” They’re already here.

Lastly, market share fell from the high point that was December 2023 (4.1%), but it’s climbing up again, and by March it was only 0.1% away from reaching that high point again. Hopefully this trend will maintain during April and then accelerate once the new arrivals start heating up competition in their respective segments.

Final thoughts

A lot of things are happening here simultaneously (or almost simultaneously), so keeping track is starting to become hard. And it’s only one country.

The government is still aiming to end diesel subsidies, but it hasn’t been able to do so due to pressure from the transportation guild, which is threatening to strike if prices go up. Regardless, several companies are bringing new and better electric trucks, so if the government gets its way, we will see a rapid increase in the sale of electric heavy vehicles.

Charging is starting to become a serious issue. The charging network has barely grown during the last 18 months, most stations have only one charger and just a few have two (so there’s little reliability and a high chance of getting stranded), and there’s the mess of four competing charging standard (CCS1, CCS2, GB/T, CHAdeMO), with another one on the way (NACS). Worse even: the government still considers CCS1 as the “official” standard in the country, forcing all charging stations to put one of these first. It’s a given that very large lines will become the norm during holidays unless infrastructure is rapidly deployed: for now, only large cities have reasonable networks, but the main roads are severely underserved. Charging adapters are becoming commonplace, with a CCS1–CCS2 adapter being sold at a couple hundred dollars and the more complex CCS1-GB/T at some $1700. Charging-as-a-service is becoming commonplace.

All in all, things are moving fast. It’s possible charging infrastructure won’t be up to the challenge, but many people may still buy EVs if they can charge at home and prices are not too far up. And that’s the core of the issue here: the faster we get to price parity, the sooner ICEV sales will be replaced by EVs. By now, at nearly 4% market share, the country is moving out of the early adopter phase and into the mainstream phase, but whether the transition accelerates in the following years will depend mainly on pricing. People want cheaper EVs, and they want them now.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Yet even though things are moving fast, nobody seems to be realizing. A friend of mine whose family owns a gas station told me that they expect business to remain as it is for another three decades, according to the National Federation of Gas Stations. One could laugh, but that’s roughly the same as what the Ministry of Mining and Energy is saying: their gasoline consumption estimation goes up linearly for 20 years even though their estimations for EV sales seem to be roughly the same as mine (~60% by 2030). It’s as if everyone assumes gasoline cars last forever, and every EV will only add to a current fleet, not replace any ICEVs. At this point I’m wondering if it’s me who’s missing the obvious!

Well, I’ve already written too much, but there’s one last thing. I said everything’s moving fast, and that’s not entirely true. Something isn’t. The electric motorcycle segment, which started very promising very early on (back in 2016), has been stagnant for years. At some 700,000 units a year, Colombia is the third largest producer and buyer of motorcycles in the Western Hemisphere (one of the main reasons its car market is so small), so economies of scale exist here, yet the market has barely grown, and local offers remain as expensive and as range limited as they were four years ago. Both industry and government seem to have dropped the ball here, badly.

Still, I remain optimistic when I take out my Super Soco for a ride. One day, all the motorcycles around me will be silent, just as mine is.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

CleanTechnica uses affiliate links. See our policy here.