Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

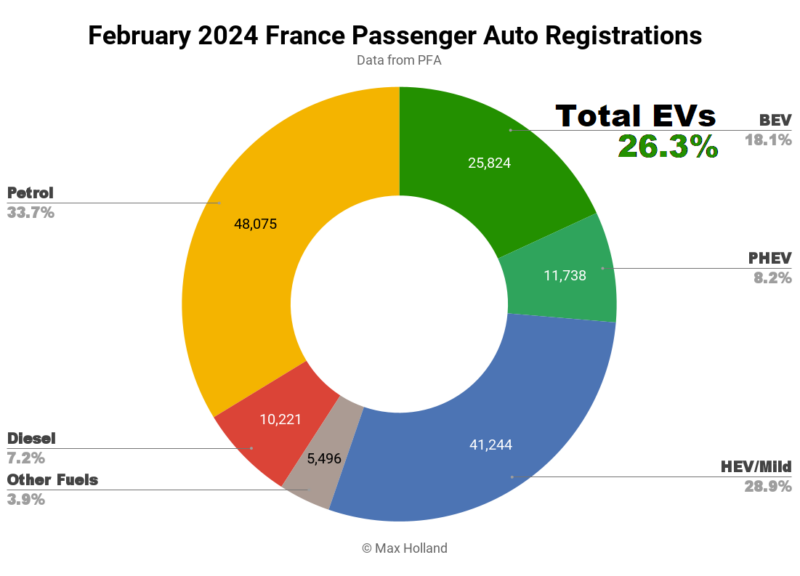

February saw plugin EVs at 26.3% share in France, up from 23.8% share, year on year. Full electric volume grew 32% YoY, and plugin hybrid volume grew 12%. February’s overall auto volume was 142,598 units, up 13% YoY, though still well below 2017–2019 norms (~190,000). The Peugeot e-208 was once again the best selling full electric vehicle.

February saw combined plugin EVs at 26.3% share in France, consisting of 18.1% full battery electrics (BEVs), and 8.2% plugin hybrids (PHEVs). These compare with YoY figures of 23.8% combined, with 15.5% BEV, and 8.3% PHEV.

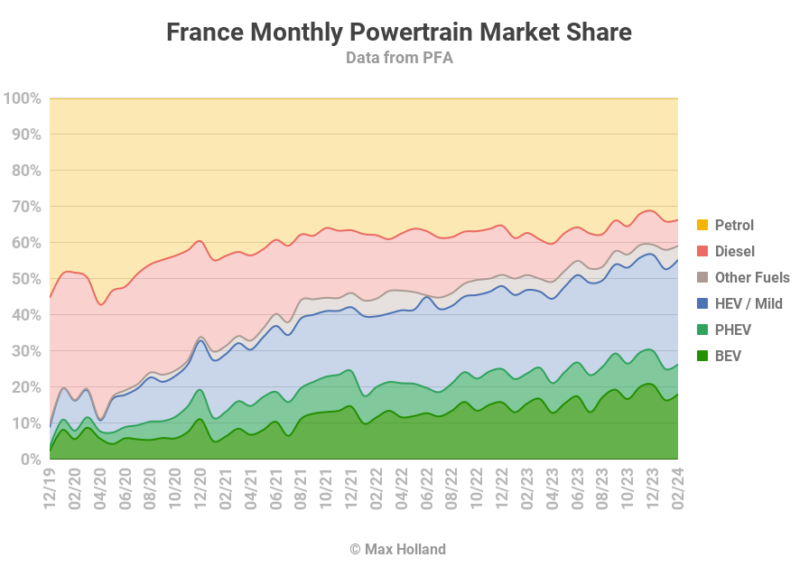

PHEVs have been on a plateau for the past 3 years, hovering close to 9% (+/- 1%) of the market. BEVs have continued to grow slowly and steadily for years. 2019 saw a full year BEV share of 1.9%, followed by 6.7% in 2020, 9.8% (2021), 13.3% (2022), and 16.8% last year (2023). With some incentives still in place (albeit thinning), 2024 looks to be another year of BEV growth, with 20% full year BEV share being possible.

This is steady progress, but not fast enough to meet medium-term goals. At this rate of roughly 3.5% gain in BEV share each year, it will take until the end of 2034 for BEVs to grab 50% of the French auto market. Considering that the goal is to get close to 100% BEV sales by 2035, this is obviously inadequate.

The problem is that BEV pricing is still very expensive for most people. Right now, in France’s highest volume auto segments, small and compact, like the Peugeot 208, Fiat 500, and Opel Corsa, BEVs are priced far above combustion alternatives. The entry combustion Peugeot 208 is listed at 19,350€ whereas the entry e-208 is 34,100€ — that is 14,750€ (57%) more expensive.

Why is a BEV so much more expensive? The widespread expectation was that — because manufacturing costs decline as new technologies mature — prices of BEVs should by now be not very different from combustion counterparts, and moving towards being less expensive than combustion, over time. These expected cost declines have indeed occurred with the key new technologies of BEVs — most importantly batteries, and also motors and power electronics.

Automotive LFP cells now cost 44€/kWh to make for the large suppliers in China (CATL, BYD, etc), and they are operating at very slim profit margins, and competing with each other on pricing. This means that the 50 kWh battery packs of small BEVs like the best selling Peugeot e-208 should cost not much more than 3,000€. Allowing a generous 2,500€ for motor and power electronics, and saving at least 2,000€ from the absent ICE, emissions treatment, ancillaries, and transmission, the BEV cost premium should only be 3,500€ at most, in this class of vehicle. This is conservative. BEV manufacturers in China are already competing head-on with ICE on price, even in segments priced well under 20,000€, using component supplies which are internationally traded.

As I pointed out in my recent Germany report “The [Dacia] Spring’s pack is ~27 kWh, a simple design with modest power and no active cooling, so should cost under 1,600€. The motor and inverters are also modest power (33 kW), so similarly inexpensive. The Renault-Dongfeng badged “Fengshen EX1” version (same car with the exact same battery and motor) had a pre-sales-tax price of under €6,000 in China.”

What is the price of the Dacia Spring in France? 18,400€… over three times the price. Even allowing a possible 2,000€ for airbags and safety upgrades — after international shipping, 10% import tax, and 20% sales tax, that 6.000€ should translate to a French sale price of well under 12,000€, not a price of over 18,000€!

In short, it looks like European car buyers are being screwed-over on BEV pricing, whilst the European automakers are making record profits. Manufacturers are apparently refusing to compete with each other on offering affordable BEVs (which points to possible price collusion), and are leaning on European politicians to shut out global competition, so they can maintain their record profits — by overcharging European consumers for the BEVs they do offer.

If BEV prices were keeping pace with the actual cost reductions in the core technologies, BEVs would already be close to parity with ICE pricing in most segments in France, just as they are in China. BEV share would also be keeping up with the speed of the transition seen in China, which — despite scoring behind France in BEV share in 2020 (6.3% vs 6.7%) — ended 2023 far ahead (25% vs 16.8%).

Let me know in the comments what you think about this whole situation of overpriced BEVs, record profits for European manufacturers, even whilst the speed of the transition is far below where it needs to be.

To finish this section on a positive note, February saw diesel market share at a record low in France, at just 7.2%, dropping from 11.7% YoY. Volume was just 10,221 units, from 14,717 units YoY.

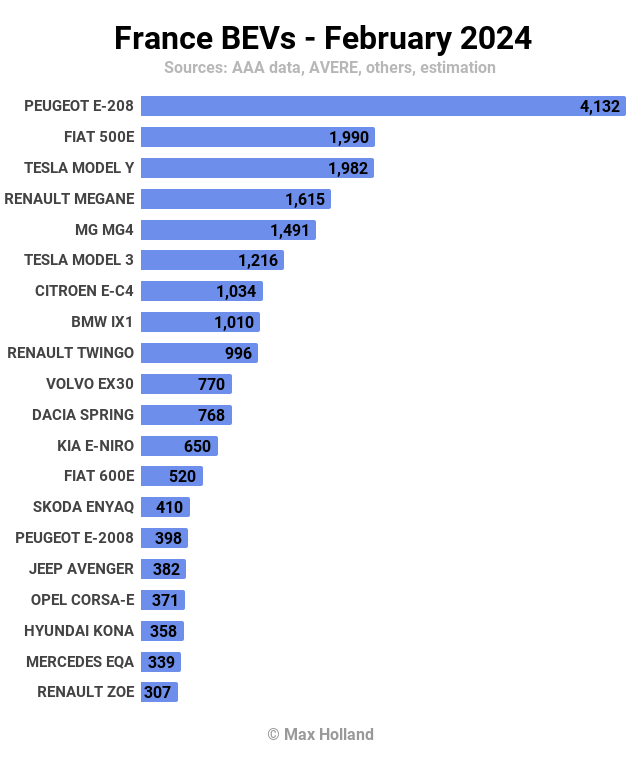

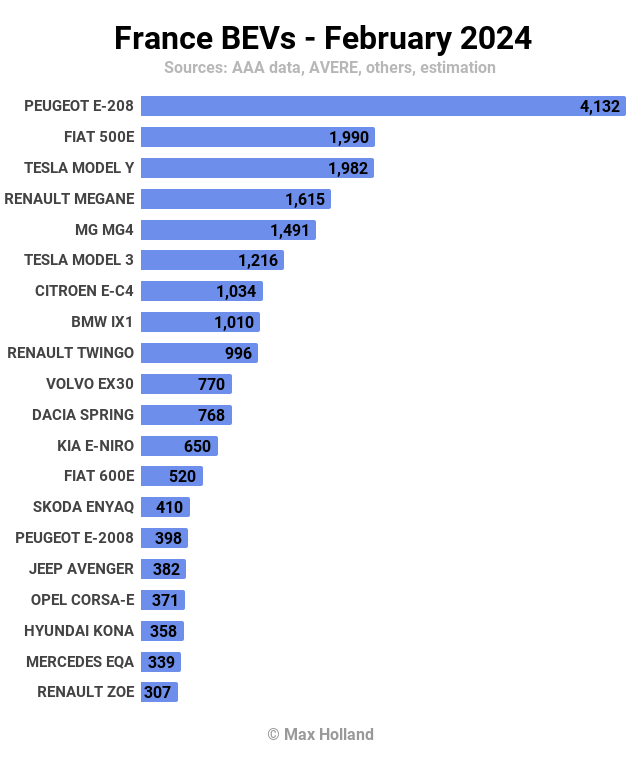

Best Selling BEVs

The Peugeot e-208 was once again the best selling BEV in France, for a second consecutive month, with 4,132 units delivered in February. In runner up position was the Fiat 500e, with 1,990 units, with the Tesla Model Y just behind, with 1,982 units.

The Citroen e-C4 saw a good jump in volume, to 1,034 units, well ahead of its recent monthly average of some 330 units. This was enough to see the e-C4 climb to 7th, from 15th in January.

Another strong climber was the new Volvo EX30, which latest data suggests debuted in January, with 307 units, and climbed strongly to 770 units, and 10th spot, in February.

The EX30, which is currently made in China, will be excluded from France’s eco-bonus incentive scheme (see recent discussion) after March 15th, so is being delivered in a rush before that date. We can expect its numbers to fall significantly after March. Volvo is planning to make the EX30 in Europe (probably Belgium) from 2025, to overcome these barriers.

Recall that several of the most popular BEV models will fall foul of the new eco-bonus rules after March 15th — essentially, any model which is made outside of Europe is excluded. Models affected include the Dacia Spring, Tesla Model 3, Kia Niro, Kia EV6, BYD Atto 3, Volvo EX30, MG4 (plus all other MGs), Ford Mustang Mach-e, Fisker Ocean, Nissan Ariya, and Toyota BZ4X (amongst several others).

We can expect all these models to pull-forward deliveries ahead of March 15th, and see a significant drop in volume from April onwards. Obviously this will mean that those BEVs still accessing the bonus will gain in sales and ranking, as the above popular models are hamstrung in the competition. The water is somewhat muddied by new pricing strategies from many of those losing access to the bonus. Let’s see how the dust settles towards the end of Q2.

The new BMW iX2 made its French debut in February, with 99 units registered. The BYD Seal has also recently debuted, with 38 initial units in January, and stepping up to 202 units in February. Since the Seal is currently only made in China , it won’t see much volume after March 15th, unless BYD is ready to adjust its pricing. A BYD European factory is being planned.

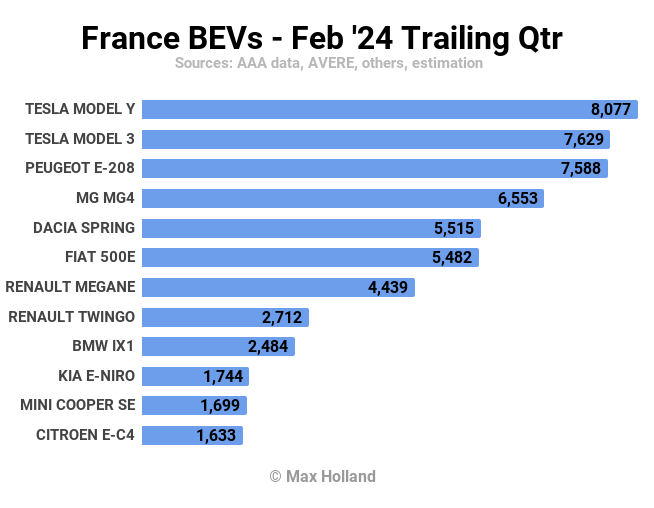

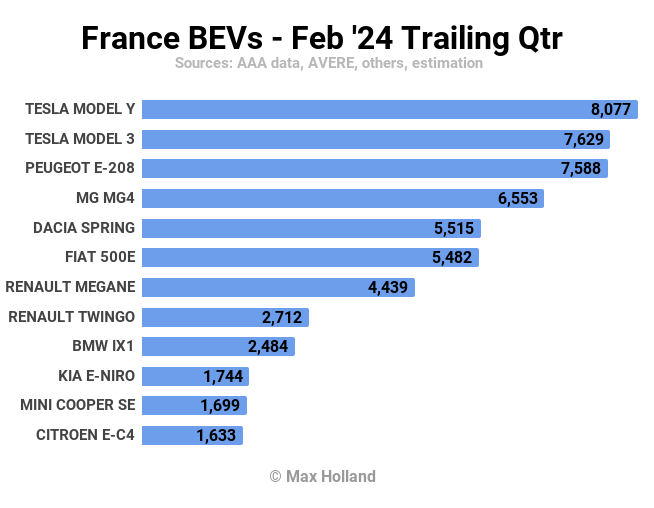

Let’s now check up on the trailing 3 month rankings:

December data was sparse, so we can only compile a reliable top 12 ranking. As usual, the Tesla Model Y is in the top spot, on the strength of 4,681 deliveries in December, and decent volumes since.

Its older sibling, the Tesla Model 3, is in second place, a higher ranking than usual, which makes sense given that the European supply is mostly made in Shanghai. It will thus lose access to the French eco-bonus after March 15th, and has been pulling-forward deliveries ahead of time. The Model Y, made in the Berlin-Brandenburg factory, remains eligible for the bonus after March.

In third is the Peugeot e-208, following on from its top spot in the most recent monthly rankings.

The MG4 and Dacia Spring are both making hay whilst the sun still shines, in 4th and 5th spots, and will likely fall back from April onwards, after losing the bonus eligibility.

The rest of the top 12 are all familiar faces, with no big movements compared to the period 3 months earlier.

Outlook

France’s GDP growth stayed above water throughout 2023, with consecutive quarterly YoY scores of 0.9%, 1.2%, 0.6%, and 0.7% (latest data). This put France ahead of many other European economies. Inflation cooled to 2.9% in February, from 3.1% in January, the lowest in over 2 years. Interest rates remain flat at 4.5%. Manufacturing PMI improved to 47.1 points in February, from 43.1 points in January.

The months ahead will see changes in BEV sales as the eco-bonus gets withdrawn for many of the most popular models. We will have to wait to see what effect this has on the overall volume of the BEV market. Hopefully those manufacturers who are able to reduce their prices will do so, in order to keep their foot in the French market.

On the other hand, if their BEV models are anyway supply constrained (relative to demand across Europe), they will presumably favour allocating units to other European markets where they can still access incentives, and thus higher margins. We will get a fuller picture of how the market has changed by the end of Q2.

What are your thoughts on the French EV transition? Please jump in to the discussion in the comments section below, and share your perspective.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

CleanTechnica uses affiliate links. See our policy here.